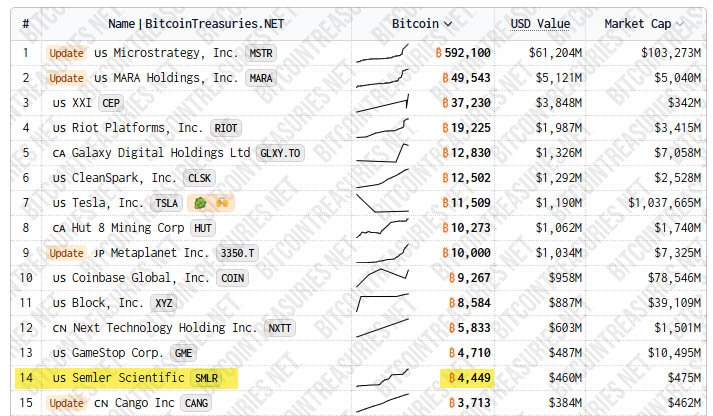

Semler Scientific, the U.S.-based healthcare technology company, is planning to become one of the largest institutional holders of bitcoin (BTC) in the world. The company currently holds around 4,449 BTC and plans to grow that to 105,000 BTC by the end of 2027.

Semler is joining a growing list of public companies that are embracing bitcoin as part of their financial strategy, following in the footsteps of Strategy which holds the most bitcoin among all public companies.

Semler’s bitcoin accumulation plan is broken down into stages: the company wants to reach 10,000 BTC by the end of 2025, 42,000 BTC by 2026 and 105,000 BTC by 2027.

To fund this plan, Semler will use a combination of equity offerings, debt financing, and operational cash flow.

“Since adopting the bitcoin standard, we have achieved approximately 287% BTC Yield and a $177 million BTC $ Gain through June 3, 2025,” said Eric Semler, the company’s chairman.

“With a strong team in place and a growing connection with the Bitcoin community, we are poised to accelerate our bitcoin accumulation strategy.”

Semler started buying bitcoin in May 2024 and is looking at it as the company’s reserve asset. As of now, its holdings are worth around $462 million according to recent filings.

To help lead the way, Semler has appointed Joe Burnett as its new Director of Bitcoin Strategy.

Burnett is a well-known Bitcoin researcher and advocate who previously worked at Unchained, a Bitcoin financial services company, and also held roles at Blockware Solutions and EY (formerly Ernst & Young).

“Joe is an analytical thought leader on Bitcoin and Bitcoin treasury companies,” said Eric Semler. “His expertise will be instrumental as we pursue our bitcoin treasury strategy and aim to deliver long-term value to our stockholders.”

“The trend to adopt bitcoin as part of corporate treasury is clearly accelerating,” he said. He described Bitcoin as “the world’s most advanced form of monetary technology” and said he believes more companies will follow suit.

After the announcement, Semler’s stock went up 14% even as bitcoin itself went down. Investors were clearly excited about the company’s bitcoin strategy and new leadership.

But Semler’s stock has had a tough year overall.

It’s down over 30% YTD and more than 50% from its 2025 highs. Analysts warn if the stock keeps going down it may limit the company’s ability to raise more funds through share issuance, which is a key part of their bitcoin strategy.

Matthew Sigel, a digital assets researcher at VanEck, says companies like Semler should rethink their bitcoin buying strategy if their stock gets too close to net asset value.

Sigel says companies using large at-the-market programs to buy bitcoin risk diluting shareholder value if their stock trades near net asset value.