Michigan lawmakers are back on track with a proposal that would allow the state to put up to 10% of its public funds into bitcoin and other digital assets.

House Bill 4087 cleared procedural hurdles this week after being dormant for more than 7 months, a big step in the state’s debate over whether to join the growing list of governments testing bitcoin reserves.

The bill, introduced in February by Republican Representatives Bryan Posthumus and Ron Robinson, amends the Michigan Management and Budget Act to create a “strategic crypto reserve.”

If passed, the bill would allow the state treasurer to invest up to 10% of money from Michigan’s general fund, countercyclical budget, and economic stabilization fund into bitcoin and other digital assets.

The Michigan Bitcoin Trade Council, however, is opposing the bill because it doesn’t restrict the state to buying only bitcoin. The group says including other “cryptocurrencies” would “create unnecessary risk” since many are “centralized and subject to great risk.”

For months, the bill had been stalled in Lansing, and many thought the initiative was dead. But on Thursday, HB 4087 moved to its second reading in the state House and was referred to the Committee on Government Operations.

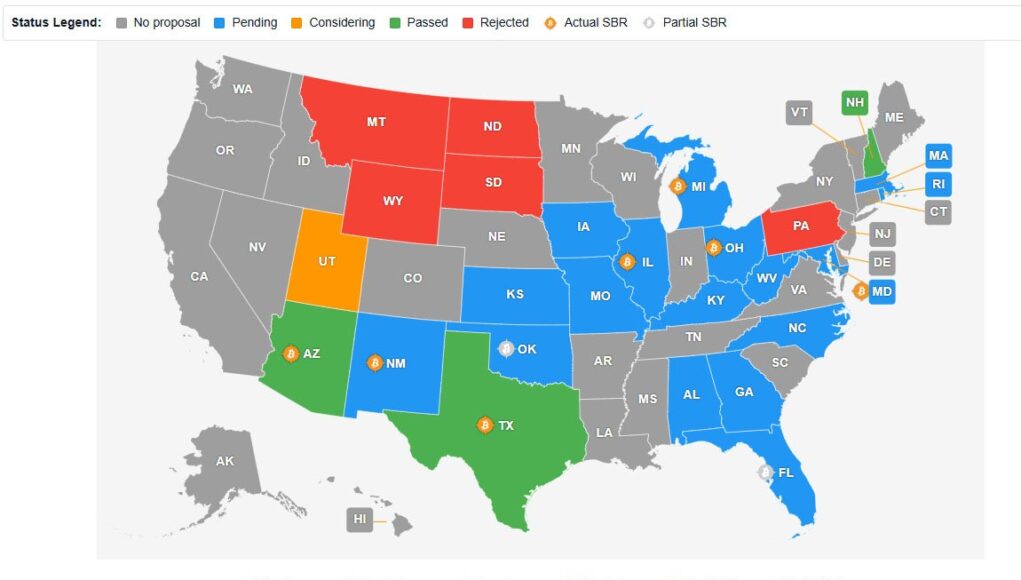

Lawmakers say the timing is a sign of renewed momentum in state-level adoption of digital assets. This is the first time it’s moved in 7 months, and state-level bitcoin adoption is showing no signs of slowing down.

Analysts believe that Michigan’s effort will put pressure on neighboring states like Ohio, Illinois, and Pennsylvania to revive their own proposals.

The bill goes beyond just allowing investment. It has strict rules for how Michigan would manage any digital holdings.

The state would have to keep exclusive government control of private keys, use encryption, have geographically diversified secure data centers, and conduct regular audits.

The bitcoin could be held in three ways: through a “secure custody solution,” a qualified custodian like a regulated bank or trust company, or exchange-traded products offered by registered investment firms.

The bill also allows the state to loan out its digital asset holdings to generate returns, as long as it doesn’t increase financial risk.

These address the issues that killed other state proposals. Taxpayers would have to trust a third-party “secure custody solution” or “qualified custodian.”

Supporters see this as part of a broader effort to diversify state assets and protect against inflation.

Advocates argue that holding reserves in assets like bitcoin can help protect against inflation and a weakening currency, similar to sovereign wealth funds that invest in commodities or alternative assets.

If passed, Michigan would be the 4th state to have a bitcoin reserve law, after Texas, New Hampshire, and Arizona. Texas has already allocated $10 million to bitcoin, the others have not funded theirs yet.