Heyo, trader—Altie here, fresh from a late-night chart binge and ready to spill the pixel tea on MGBX.

This review’s been a deep dive through their order books, futures screens, and that sneaky Rewards Hub they’re so proud of. We’ve tracked the whole journey—from Megabit in 2019 to the full-on MGBX rebrand in 2025—and weighed the sweet perks against the “hmm, maybe not” moments.

So whether you’re here for the 200× YOLO futures, the high-limit no-KYC withdrawals, or just a new spot to park your crypto playbook, this guide lays it all out. Think of it as your honest market readout—with a little sass in the margins.

MGBX, the exchange formerly known as Megabit, has recently stepped into the spotlight with a rebrand that signals more than a cosmetic refresh.

This isn’t just about swapping a logo or polishing a homepage—it’s about repositioning itself in the hyper-competitive cryptocurrency exchange market. While many platforms chase the “biggest in the world” title, MGBX seems to be aiming for “smartest choice for agile traders.”

Its niche is clear. Rather than focusing on rigid compliance structures that slow user onboarding, MGBX leans into speed, accessibility, and variety.

This puts it squarely in the crosshairs of a growing trader demographic—those who want a broad selection of coins, competitive fees, and deep liquidity, but also want the freedom to operate with minimal verification friction.

The exchange offers a suite of services on par with much larger platforms: spot trading for everyday buy-sell activity, a robust futures market with high leverage for the risk-hungry, and copy trading for those who prefer to follow the moves of seasoned players.

These aren’t afterthought features—they’re built into the core user journey, designed to hook both casual traders and experienced market tacticians.

From a market position perspective, MGBX sits in an interesting middle ground.

It isn’t a newcomer scrambling for relevance, nor is it a legacy titan bogged down by bureaucracy. Instead, it’s an adaptable, globally-oriented platform that operates in over 180 countries.

The rebrand to MGBX reinforces a modern, tech-forward identity that appeals to the visually driven, convenience-seeking crypto user—traders who might see the long verification queues at some exchanges and decide their capital is better deployed elsewhere.

MGBX also benefits from the current climate in crypto exchanges, where users are increasingly looking for alternatives to the top two or three giants.

Trust in the biggest names has been dented in recent years, whether through compliance issues, service outages, or publicized disputes.

A mid-sized, privacy-friendly exchange like MGBX can leverage this skepticism by presenting itself as stable, responsive, and user-first—qualities that resonate strongly with a generation of traders who’ve seen too many “too big to fail” names stumble.

In short, MGBX’s position in the exchange landscape is less about shouting the loudest and more about quietly being the most convenient, versatile option in a trader’s toolkit.

Its competitive edge comes from pairing essential trading functionality with a brand identity that feels fresh, unburdened, and a bit rebellious against the over-regulated norm.

Background & Overview

MGBX began life in 2019 under the name Megabit, entering a crypto market that was just starting to mature from its chaotic early years.

At that time, the industry was dominated by a few massive exchanges, but there was still plenty of room for specialized platforms that could carve out a user base by offering speed, variety, and less friction in onboarding.

Megabit positioned itself as exactly that—an exchange for traders who valued agility over bureaucracy.

From its earliest days, the platform focused on accessibility. While some competitors insisted on complex verification processes before allowing meaningful trading activity, Megabit took a more user-friendly approach.

This helped it quickly attract traders from regions where regulatory restrictions or local banking hurdles made it difficult to use larger exchanges. By building a framework that was open to international participation, the exchange steadily grew its reach.

Fast forward to April 2025, and the rebrand to MGBX marked both a symbolic and functional shift.

The change wasn’t purely aesthetic—it was a deliberate repositioning in response to the evolving crypto landscape. The new name reflects a more modern, globally-oriented identity, aligning with a push toward an updated interface, stronger technical infrastructure, and an expanded product suite.

The rebrand also served as a public statement: MGBX was ready to compete more aggressively for global market share, leveraging its years of operational experience under the Megabit banner.

Today, MGBX serves a user base of more than 10,000 active traders spread across over 180 countries.

This is no small feat for a mid-tier exchange, as it signals the platform’s ability to operate across different market conditions and adapt to varying user expectations.

The listing roster has grown to more than 100 cryptocurrencies, covering not just major assets like Bitcoin and Ethereum but also a wide range of altcoins, providing opportunities for speculative trading, diversification, and niche market plays.

This global reach isn’t just about numbers—it’s about positioning. MGBX sits in the “globally accessible, regionally nimble” category.

While it doesn’t carry the regulatory licenses that some top exchanges use as a marketing badge, it has built a reputation for being available where others may be restricted. For privacy-conscious traders, especially in jurisdictions with uncertain or rapidly changing crypto laws, this can be a decisive factor when choosing where to trade.

Core Features & Trading Options

MGBX doesn’t settle for being just a place to swap tokens—it’s built to be a multi-mode trading hub. The platform’s offering is spread across several core services, each tuned for a different kind of trader.

Spot Trading

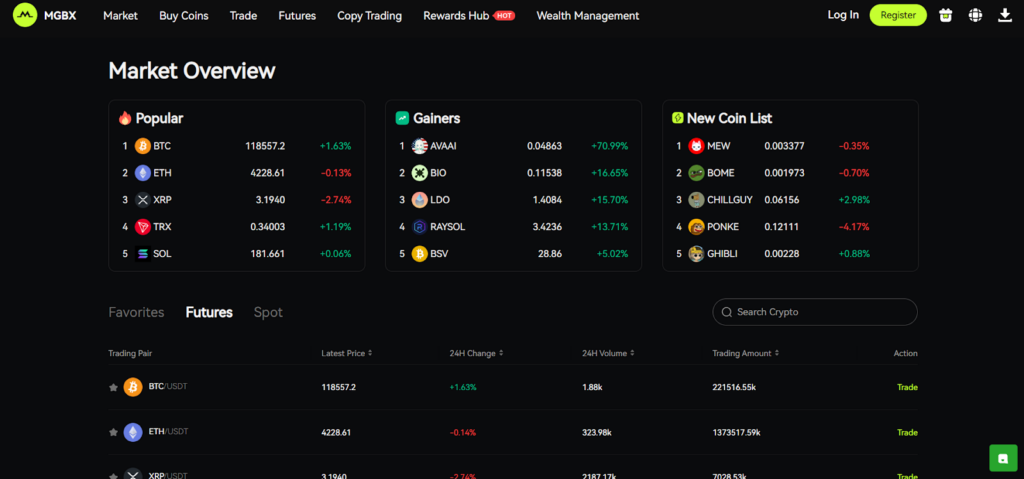

This is the bread and butter of the exchange. The spot market on MGBX supports more than 100 crypto pairs, covering the usual heavyweights like BTC/USDT and ETH/USDT, but also a rotating cast of altcoins that bring both volatility and opportunity.

Liquidity here is decent for a mid-tier exchange, and the order matching engine is engineered for low latency execution, so you’re not sitting there watching your order crawl while the market moves.

Futures Trading

For the leverage chasers, MGBX offers contracts with leverage up to an eye-watering 200×. That’s enough to turn a small win into a big payday—or a mistimed entry into a margin call nightmare.

Futures come with both USDT-margined and coin-margined contract types, giving flexibility depending on whether you want to hold collateral in stablecoins or crypto itself. Risk controls like auto-deleverage and position limits are in place, but with leverage this high, responsibility is on the trader’s side.

Copy Trading

Not everyone has time to grind charts or ride out every pump and dump. MGBX’s copy trading feature lets you mirror the trades of experienced strategists in real time.

It’s aimed at newer traders who want to learn by observation, as well as those who just want to outsource the decision-making while focusing on portfolio growth. You can choose which traders to follow based on performance stats and risk levels.

C2C / Peer-to-Peer Trading

The platform also supports direct, user-to-user crypto transactions.

This peer-to-peer marketplace is useful for buyers and sellers in regions where direct bank integration is tricky or where they prefer negotiating custom rates. Escrow services help reduce counterparty risk.

Technical Highlights

Under the hood, MGBX has invested in speed and resilience. Its matching engine is optimized for high throughput and low delay, which is critical for both scalpers and high-frequency traders.

AI-driven trading tools provide market insights, automated trade signals, and even help with strategy execution. Slippage compensation—a feature that refunds or adjusts orders if execution prices deviate too far from the intended level—adds another layer of user protection.

Security Infrastructure

Security is one of MGBX’s calling cards. It combines cold storage for the majority of funds with multi-signature wallets to prevent single-point breaches. A $50 million insurance fund is in place to cover specific security incidents.

On the user side, 2FA authentication, SSL encryption, and real-time risk monitoring systems are standard. While these measures don’t eliminate all risk, they put MGBX in line with best practices for exchange security.

Rewards Hub

To keep engagement high, MGBX runs a dedicated Rewards Hub. Here, users can participate in campaigns to earn bonuses, trading fee discounts, or other perks.

Activities range from trading competitions and referral challenges to staking promotions. This gamified layer serves as both an onboarding incentive for new users and a retention strategy for active traders.

In combination, these features make MGBX more than just a spot market—it’s a platform with multiple trading avenues, strong security underpinnings, and engagement mechanics that try to keep you logging in daily.

Fees, Limits & Regulatory Context

Trading Fees

MGBX keeps its spot trading fees at around 0.1% for both makers and takers, which puts it right in line with other competitive mid-tier exchanges.

For futures, fees dip slightly lower, rewarding the higher-risk, higher-volume activity that leveraged products bring.

The platform’s fee schedule is straightforward—no overly complex tier ladders that make you pull out a calculator every time you check your balance.

Withdrawal fees aren’t flat; they vary depending on the asset and blockchain network you’re moving funds on.

This can work in your favor if you’re careful with network choices, but it also means you need to check rates before every withdrawal to avoid paying more than you expect.

No-KYC Allowance

One of MGBX’s strongest—and most controversial—selling points is its high-limit, no-KYC policy. You can trade and withdraw up to USD 100,000 per day without submitting identity documents.

That’s almost unheard of among major exchanges in 2025, where stricter regulations have forced most platforms to demand full verification even for small transactions.

For privacy-focused users or those in jurisdictions with cumbersome ID processes, this is a huge draw.

Of course, it also puts the platform under closer scrutiny from regulators, which brings us to the compliance question.

Regulatory Status

MGBX operates without an official license from major financial authorities.

This unlicensed status gives it operational freedom, but it also means the platform is officially restricted in several high-regulation regions, including the United States and Hong Kong.

Users in these areas either can’t access the platform or do so through risk-laden workarounds, which may violate local laws.

The lack of licensing also means there’s no formal recourse if something goes wrong—you’re relying on the exchange’s own security measures and insurance fund rather than a regulated safety net.

Risk Implications

The upside of this model is flexibility, speed, and privacy.

The downside is that you’re trading on a platform that could face sudden service changes if regulators decide to tighten the net.

It’s not the place for users who demand full regulatory oversight, but it’s attractive for those who prioritize anonymity and high limits over the security of licensed operations.

In short, MGBX’s fee structure is competitive, its no-KYC limit is unusually high, and its regulatory positioning is both a strategic advantage and a potential long-term risk, depending on where you stand in the privacy-versus-compliance debate.

Pros & Cons

Pros

Diverse Trading Options

MGBX isn’t just a one-trick exchange. It gives you spot trading for straightforward buy-and-sell, high-leverage futures for aggressive plays, copy trading if you’d rather follow pros than grind charts, and a C2C marketplace for direct peer deals.

That variety means you can keep multiple strategies under one roof instead of juggling accounts across platforms.

Security and Protection

For an unlicensed exchange, MGBX takes its internal security seriously. Cold storage keeps the majority of funds offline, multi-signature wallets prevent single-point failures, and there’s a $50 million insurance fund in place for emergencies.

Combined with standard protections like SSL encryption and two-factor authentication, it positions itself as trustworthy within its operational model.

High-Limit Privacy

The ability to trade and withdraw up to $100,000 a day without KYC is practically extinct in 2025’s regulatory climate.

For users who value anonymity—whether for personal security, privacy, or political reasons—this is one of the biggest draws.

Beginner-Friendly Onboarding

Copy trading isn’t just a passive income tool—it’s a learning resource. New traders can observe strategies in action, see how experienced users manage risk, and build confidence before flying solo.

Combined with a relatively clean interface, it’s easy to get started without feeling buried in advanced settings from day one.

Cons

No Transparent Licensing or Independent Audits

While MGBX claims strong internal safeguards, there’s no third-party audit or formal licensing to confirm those claims.

That means trust is based on the exchange’s history and reputation, not on regulated guarantees.

Regulatory Risks

Operating in restricted markets means that users in certain regions face the risk of account limitations or outright access loss if enforcement tightens.

Traders in high-regulation countries like the US or Hong Kong may have to bypass restrictions, which adds legal and operational risk.

Market Depth Compared to Giants

While liquidity is solid for a mid-tier platform, it’s not going to match the deep order books of top-tier exchanges like Binance. Large orders in less popular pairs may experience more slippage.

In summary, MGBX’s pros hit hard for privacy-seekers and multi-strategy traders, but the lack of licensing and regional restrictions could be dealbreakers for users who need regulatory assurance or massive liquidity at all times.

Comparisons & Positioning

Versus Binance

Binance is the undisputed heavyweight in terms of liquidity, market depth, and range of services.

It has regulatory licenses in multiple jurisdictions, plus an enormous user base and a wider selection of coins.

Where MGBX differentiates itself is in onboarding speed and privacy—Binance requires KYC for virtually all meaningful account activity, while MGBX still offers high-limit no-KYC trading.

Binance also has far deeper liquidity across all pairs, but that comes with slower account opening for privacy-conscious users and heavier compliance oversight. MGBX is faster to start using, but Binance is more secure from a regulatory standpoint.

Versus Bitget

Bitget shares a similar audience focus—especially on futures and copy trading. Both platforms promote high-leverage contracts and influencer-driven trading leaderboards.

However, Bitget’s maximum leverage typically caps out lower than MGBX’s 200×, and Bitget is more compliance-oriented in its global expansion.

MGBX pulls ahead for traders who want higher leverage and looser verification rules, while Bitget offers a more established regulatory footprint and often better liquidity in certain futures markets.

Versus MEXC

MEXC, like MGBX, has carved out a niche in offering a wide variety of altcoins and maintaining an accessible signup process. Both appeal to users who want to trade a lot of different tokens without heavy restrictions.

The difference is that MEXC has built more market depth over time and has a longer track record in the mid-tier exchange space.

MGBX’s advantage lies in the higher no-KYC limits and newer technical upgrades, such as its AI-driven trading tools and slippage compensation.

Overall Positioning

MGBX isn’t trying to be the next all-encompassing, fully licensed global exchange.

Instead, it positions itself as a nimble, privacy-friendly platform with competitive trading tools and a focus on speed and variety.

That makes it appealing to a segment of traders who feel boxed in by the stricter onboarding and compliance processes of the biggest players.

The trade-off is clear: less bureaucracy and more flexibility in exchange for less regulatory assurance and, in some cases, thinner liquidity in niche pairs.

Conclusion

MGBX has evolved from its Megabit origins into a globally accessible, multi-functional exchange that leans heavily into speed, flexibility, and privacy.

It doesn’t try to beat the largest players on regulation or liquidity—it wins by keeping the door open to traders who value minimal friction and diverse trading tools in a single platform.

Its strongest assets are the combination of varied markets—spot, futures up to 200× leverage, copy trading, and C2C—and its no-KYC allowance of up to $100,000 per day in withdrawals.

That’s paired with competitive fees, solid internal security measures, and engagement features like the Rewards Hub to keep activity levels high.

The flip side is that MGBX operates without major financial licenses and is restricted in high-regulation regions like the US and Hong Kong.

For some users, that’s a red flag—particularly those who prefer the extra safety net that comes with licensed exchanges. Liquidity is respectable but not on the scale of Binance or MEXC, so large trades in less popular pairs can see more slippage.

Who It’s Best For

MGBX is ideal for privacy-conscious traders, frequent futures users who want higher leverage options, and those who want multiple trading formats without spreading their activity across several platforms.

It’s also appealing to users in regions underserved by top-tier exchanges.

Who Should Be Cautious

If you operate in a strictly regulated market, require deep liquidity for institutional-scale trades, or need the reassurance of fully licensed compliance, MGBX might not be your safest choice.

The lack of independent audits and formal licensing means you’re relying on the exchange’s reputation and security track record rather than legally enforced protections.

Final Word

MGBX isn’t for everyone—and it doesn’t try to be. It’s a sharp, agile tool for traders who prioritize control and flexibility over compliance paperwork.

In the right hands, it can be a highly effective exchange. In the wrong jurisdiction, or without proper risk management, it could carry avoidable exposure. As with any exchange choice, know your own risk tolerance and trade accordingly.

Altie’s Rating: 7.8/10

Solid tech, spicy privacy limits, and plenty of trading toys, but the no-license status and regional restrictions mean you’ve gotta know your own risk appetite before aping in. 🚀📊

FAQs

1. Do I need to verify my identity to use MGBX?

No, you can trade and withdraw up to USD 100,000 per day without completing KYC. However, this no-KYC allowance may be restricted depending on your jurisdiction, and trading in certain regions could carry legal risk.

2. Is MGBX regulated or licensed?

MGBX does not hold major financial licenses. While it has strong internal security measures and an insurance fund, it is not regulated in the same way as exchanges like Binance or Coinbase. This offers more flexibility but less regulatory protection.

3. What types of trading does MGBX offer?

MGBX supports spot trading, high-leverage futures (up to 200×), copy trading, and peer-to-peer (C2C) transactions. It also offers AI-driven tools, a Rewards Hub for incentives, and slippage compensation for certain trades.

![6 Top Copy Trading Platforms [Important Read] 2025](https://chainarticles.com/wp-content/uploads/2025/08/Desktop-2021-12-02T233829.343-1-238x178.png)