Huma Finance is shining. Bitcoin dropped by over $4,000, while meme coins posted double-digit losses. Will the DeFi token extend gains?

The past 24 hours have been tumultuous for crypto and Bitcoin holders. Just when traders anticipated a sharp uptick, pushing the digital gold above $110,000, bears intervened with their own plans. Prices crashed by over $4,000, driving Bitcoin toward the psychological $100,000 mark.

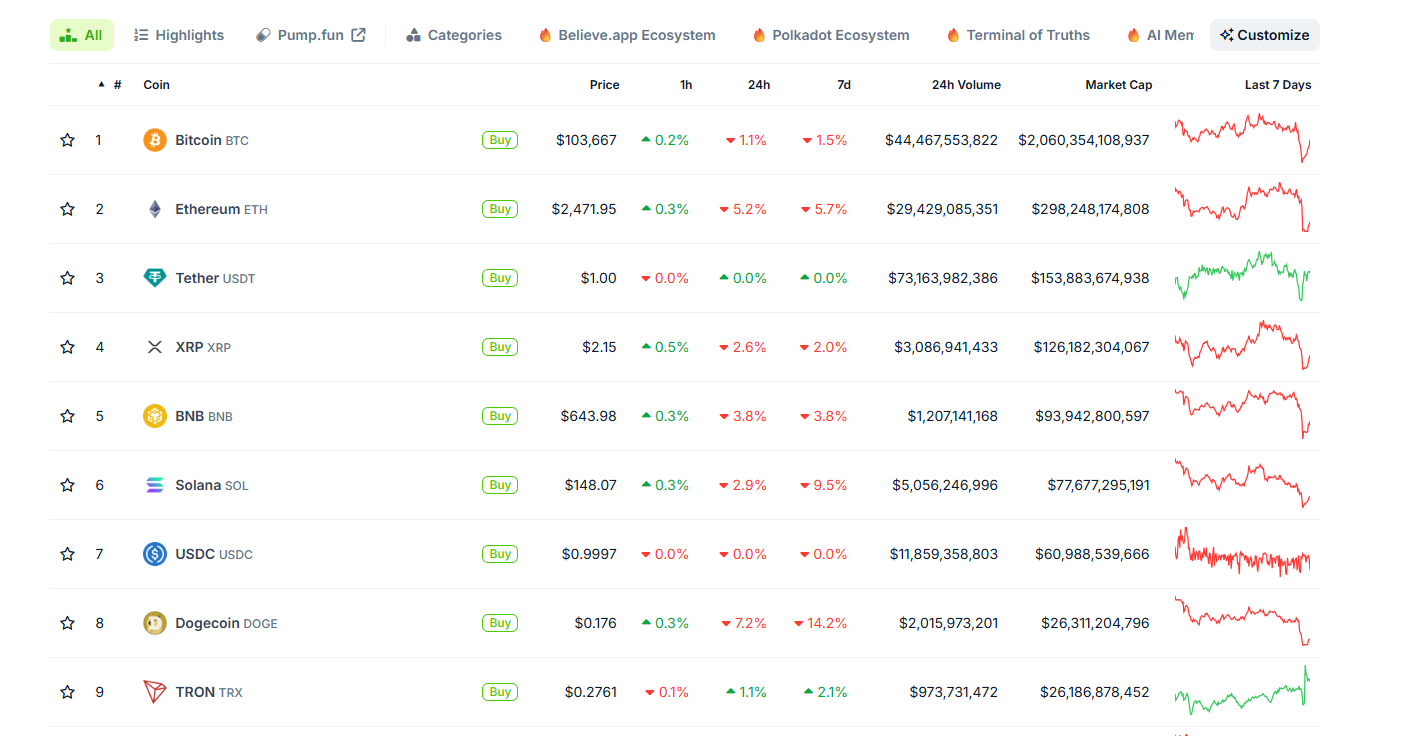

As expected, the sell-off negatively impacted altcoins, including some of the best Solana meme coins. All top 10 cryptos, except stablecoins, which held steady at $1 as a refuge for cautious traders, posted losses.

Solana dropped 3%, with weekly losses exceeding 9%, while Dogecoin stumbled, shedding over 7% and accumulating weekly losses of more than 14%.

(Source)

DISCOVER: Top 20 Crypto to Buy in June 2025

Huma Finance Defying Gravity

Amid the altcoin sell-off, a few tokens stood firm, defying the downturn. Huma Finance remained resilient, confronting bears head-on and rejecting attempts to reverse recent gains.

By the close of June 5, HUMA, the token powering the DeFi project, was up nearly 5%, offsetting losses after a 27% drop over the past week. Since bulls held strong, HUMA is now up 18% from its May 31 lows, though it remains 60% from its all-time highs recorded on May 26.

(HUMAUSDT)

As Bitcoin and altcoins turned red, Huma Finance’s resilience, despite early June losses, signaled a robust foundation capable of withstanding the toughest crypto bear markets.

Increased community engagement and platform activity bolstered this strength, and if bulls maintain momentum with higher highs today, Huma Finance could end the week strongly, building long-term momentum.

Following its TGE event on May 26 and listings on top exchanges like Binance and Bybit, HUMA surged, rising to around $0.12. The token then unexpectedly retraced to $0.034 before recovering to current levels. Even so, HUMA is up 3X from its May lows, with the uptrend post-listing still intact, qualifying it among the best cryptos to buy.

Will HUMA Extend Gains?

The initial drop after listing stemmed from liquidations following the airdrop of 500 million HUMA.

Eligible Solana holders, including early supporters, community contributors, and liquidity providers, rushed to claim their shares and likely sold, cashing out during the initial spike.

$HUMA claim & stake is now live!

Claim window ends June 26th 11:59PM UTC. https://t.co/seWFi6xFKz pic.twitter.com/vrCVsuAWlv

— Huma Finance

(@humafinance) May 26, 2025

The claim window remains open until June 26.

With the reintroduction of permissionless lending pools offering high APYs averaging 10.5%, Huma Finance could attract more activity, supporting price growth.

BREAKING NEWS – Huma 2.0 is OPEN again for deposits!

Classic Mode = 10.5% APY + 1x / 3x / 5x Huma Feathers

Maxi Mode = 5x / 10.5x / 17.5x Huma Feathers

100,000 USDC limit per wallet, democratizing REAL YIELD

Real Life, Real Yield – built on @Solana!

Start earning… pic.twitter.com/T765d9m7rf— Huma Finance

(@humafinance) May 12, 2025

Additionally, partnerships with prominent crypto firms like Kaito AI and Jupiter DAO, whose JUP stakers had priority access to the HUMA presale following approval by Jupiter DAO, strengthen its position.

The @jup_dao alliance with @humafinance has officially passed!

What’s coming:

• Exclusive presale for $JUP stakers

• $250K treasury swap ($JUP$HUMA)

• Jupiter Community activation pic.twitter.com/w7dzbNWkxJ— JUP Reddit Updates (@JUPreddit) May 22, 2025

Already, their deal with Arf One, a DeFi platform focused on institutions, could help the protocol carve market share as it strives to play a global role in payments.

Stablecoin szn! All day, every day.

PayFi is accelerating to offer faster, more inclusive financial experiences than traditional rails.Through @arf_one, Huma supports licensed financial institutions worldwide — scaling responsibly as stablecoin regulation evolves. The chart… https://t.co/Ty7DcUvGOl pic.twitter.com/BnNEQAjhFl

— Huma Finance

(@humafinance) May 30, 2025

Backing from top crypto VCs also provides Huma Finance with the financial power to compete, incentivize its community, attract users, and carve out market share.

As of June 6, the platform had processed over $4.7 billion in transaction volume, drawing over $103 million in liquidity.

DISCOVER: 7 High-Risk High-Reward Cryptos for 2025

Huma Finance DeFi Ticks Higher, Outshining Bitcoin

- Huma Finance outshines Bitcoin, rises despite market sell-off

- TGE and airdrop may explain the initial dip

- Will Bitcoin recover and stay above $100,000?

- Huma Finance is up 300% from May lows. Will the rally continue?

2025

The post Huma Finance Defies Gravity as Bitcoin Plummets Over $4,000: What’s Happening? appeared first on 99Bitcoins.