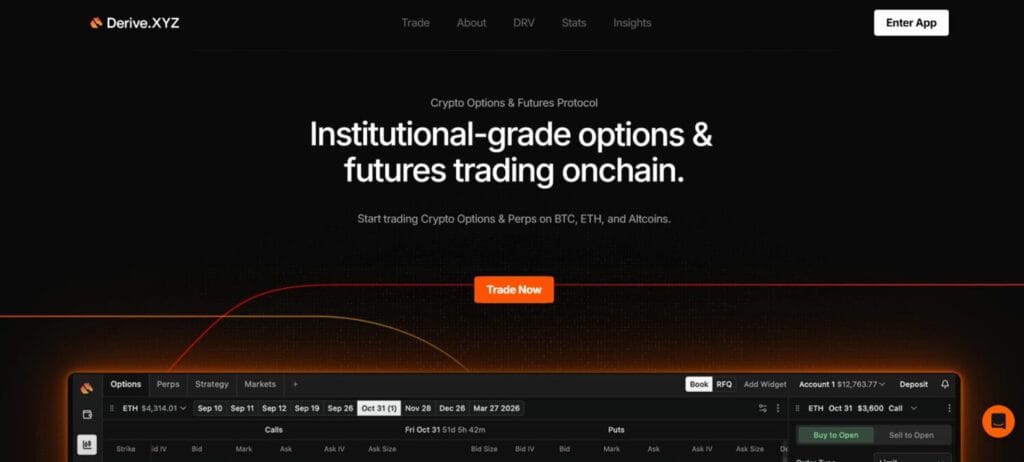

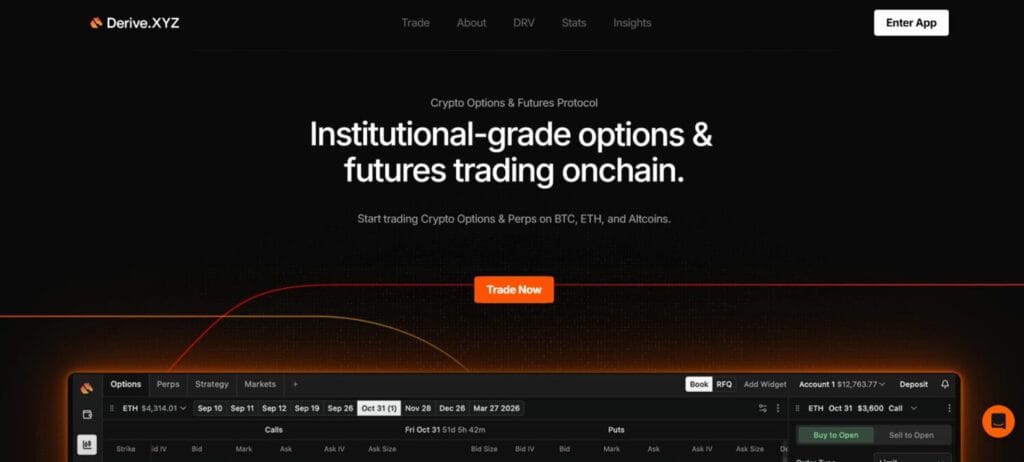

Derive is a decentralized trading platform focused on bringing institutional-grade crypto derivatives to Web3. It enables users to trade options, perpetuals, and spot assets with self-custody, advanced risk management, and capital-efficient margining. Designed for professional and advanced traders, Derive combines high-performance execution with on-chain transparency, making this overview a concise Derive review for serious crypto traders.

What is Derive?

Derive is a decentralized, on-chain derivatives trading platform built on Ethereum that enables users to trade sophisticated financial instruments like options and perpetual futures in a self-custodial way. It combines the speed and order execution quality often found on centralized exchanges with the transparency, security, and programmability of decentralized finance.

Unlike typical DeFi spot exchanges, Derive focuses on bringing complex financial instruments on-chain with capital efficiency, transparent settlement, and Ethereum security. It bridges traditional derivatives market practices with decentralized execution and self-custody.

How does Derive Work?

Derive uses a hybrid system that combines fast trade execution with secure on-chain settlement and self-custodial fund management. Its unified margin and automated risk controls enable efficient and professional-grade decentralized trading.

- Wallet-Based Account Creation: Users connect their Web3 wallet to Derive, and their trading account is created without requiring custody of funds.

- Self-Custodial Fund Management: All assets remain in the user’s wallet-controlled account, ensuring full ownership and control at all times.

- Unified Cross-Margin System: All positions share one collateral pool, allowing better capital efficiency and lower liquidation risk.

- Off-Chain Order Matching: Trades are matched through a fast off-chain engine to provide low-latency execution.

- On-Chain Settlement: After matching, trades are settled on the blockchain to ensure transparency and security.

- Multi-Product Trading: Users can trade options, perpetual futures, and spot markets from a single platform.

- Automated Risk Management: The system continuously monitors margin levels and manages liquidations automatically.

- Perpetual Funding Mechanism: Funding rates are used to keep perpetual prices close to spot market prices.

- Block Trading via RFQ: Large traders can execute big orders through RFQ without disturbing market prices.

- DRV Token and Governance: The DRV token is used for staking, rewards, and voting on protocol decisions.

Also, you may read Coinbase Staking – Earn staking rewards on your Crypto

Derive Review: Core Features

Institutional-Grade On-chain Execution

- High-performance trading infrastructure with low latency.

- Off-chain order matching with on-chain settlement.

- Optimized for high-frequency and professional traders.

- Ethereum-secured settlement layer for reliability.

Multi-Product Derivatives Support

- Call and put options on major crypto assets.

- Perpetual futures (no expiry contracts).

- Spot trading pairs.

- Structured products and yield vaults.

Portfolio & Cross-Margining System

- Unified margin across multiple positions.

- Portfolio-based risk calculation.

- Efficient collateral utilization.

- Support for multiple collateral assets.

Advanced Trading Tools

- Block RFQ (Request for Quote) for large trades.

- Cross-asset collateralization.

- API access for algo and institutional traders.

- Support for complex order strategies.

Self-Custodial Trading Architecture

- Users retain control of private keys.

- No centralized custody of funds.

- Wallet-based trading.

- Transparent on-chain settlement.

Also, you may read HyperLiquid vs Drift vs AsterDex

DRV Token: Utility and Governance

The DRV token is the native utility and governance asset of the Derive ecosystem, designed to align users, traders, and protocol stakeholders.

Governance Rights

- DRV holders can participate in protocol governance.

- Vote on upgrades, fee structures, incentives, and roadmap proposals.

- Influence key decisions through the Derive DAO framework.

Staking and Rewards

- Users can stake DRV to earn protocol incentives.

- Staking helps secure and stabilize the ecosystem.

- Rewards are distributed based on participation and contribution.

Fee Sharing and Buyback Mechanism

- A portion of protocol revenue is used to buy back DRV.

- Buybacks help reduce circulating supply over time.

- Aligns token value with platform performance.

Ecosystem Incentives

- DRV is used to reward active traders and liquidity providers.

- Encourages long-term engagement.

- Supports growth of market liquidity.

Utility Within the Platform

- Used for governance participation.

- Access to certain protocol features and programs.

- Potential fee benefits and priority access (as per future upgrades).

Also, you may read Top 10 Polymarket Analytics Tools

Derive Review: Security and Reliability

- Smart Contract Audits: Derive’s core smart contracts are audited by independent security firms to identify and mitigate vulnerabilities.

- On-chain Settlement: All trades and balances are settled on-chain, ensuring transparency, immutability, and verifiable execution.

- Self-Custodial Infrastructure: User funds remain in their own wallets, eliminating risks associated with centralized custody.

- Risk Management Systems: Automated margin monitoring and liquidation mechanisms help prevent systemic failures and bad debt.

- Secure Matching Engine: The off-chain matching engine is designed with strict security controls to prevent manipulation and downtime.

- Ethereum Security Layer: The protocol leverages Ethereum’s security and decentralization for final settlement and asset protection.

- Continuous Monitoring: Real-time system monitoring and anomaly detection help identify and respond to potential threats quickly.

- Infrastructure Resilience: Redundant systems and failover mechanisms ensure high availability and operational stability.

Also, you may read DAO Governance in Real-World Assets: How Decentralization Is Reshaping the $15 Billion Market

Derive Review: Fee Structure

| Instrument | Maker Fee | Taker Fee | Notes |

|---|---|---|---|

| Perpetuals (Perps) | 0.005% × notional volume | $0.10 base fee + 0.03% × notional volume | Maker pays percentage only, takers pay base fee + percentage |

| Options | 0.03% × notional volume | $0.50 base fee + 0.04% × notional volume | Option fees have a cap at 12.5% of option value |

| Liquidation Fee | N/A | 10% of liquidated value | Charged if positions are liquidated |

| Interest on Borrowed USDC | N/A | Interest based on utilization curve | Applies only when holding negative/usdc debt |

Conclusion

Derive stands out as one of the most feature-rich, capital-efficient, and professional-oriented on-chain derivatives platforms in the DeFi ecosystem. It bridges institutional market design and decentralized execution, with robust utility via the DRV governance token and a diverse set of trading products.

However, sophisticated product complexity and DeFi risk should be thoroughly understood before trading. Overall, Derive represents a significant evolution of decentralized derivatives markets, pushing Web3 trading beyond basic swaps into institutional-like capabilities.

Frequently Asked Questions (FAQs)

Is Derive centralized or decentralized?

Derive is decentralized and self-custodial. Users trade directly from their wallets without giving up fund control.

What products can I trade on Derive?

You can trade options, perpetual futures, spot pairs, and structured products.

What is the DRV token used for?

DRV is used for governance, staking, and participating in protocol incentives.

Does Derive charge trading fees?

Yes. Trading fees apply, and part of the revenue is used for DRV buybacks and ecosystem rewards.