Unitas is Unipay’s on-chain “dollar + yield” system built on Solana, designed to offer a stable, yield-bearing digital dollar through its tokens USDu and sUSDu. In this article, we will explore the Unitas review.

What is Unitas?

Unitas is a decentralized, yield-bearing stablecoin protocol designed to deliver a more resilient and efficient alternative to traditional dollar systems. Operating natively on Solana, it issues stablecoins such as USDu that maintain value through over-collateralization and delta-neutral hedging strategies rather than depending on banks or centralized lenders. By embedding automated yield generation directly into the protocol, Unitas enables users to hold or transact in stable digital dollars that continually accrue value. Its high-speed, low-cost infrastructure ensures scalability and censorship resistance, positioning Unitas as a foundational layer for next-generation financial applications, global payments, and on-chain liquidity ecosystems.

Unitas Review: Features and Products

- The protocol is powered by a JLP delta-neutral arbitrage engine that supplies liquidity to perp markets while neutralising asset exposure, capturing a large share of trading fees generated by SOL, ETH, WBTC, USDC and USDT markets to produce consistent, market-independent yield.

- USDu functions as an over-collateralised, soft-pegged stablecoin backed by diversified assets and hedging strategies, designed to maintain dependable USD stability without relying on unsecured lending or volatile price appreciation for value support.

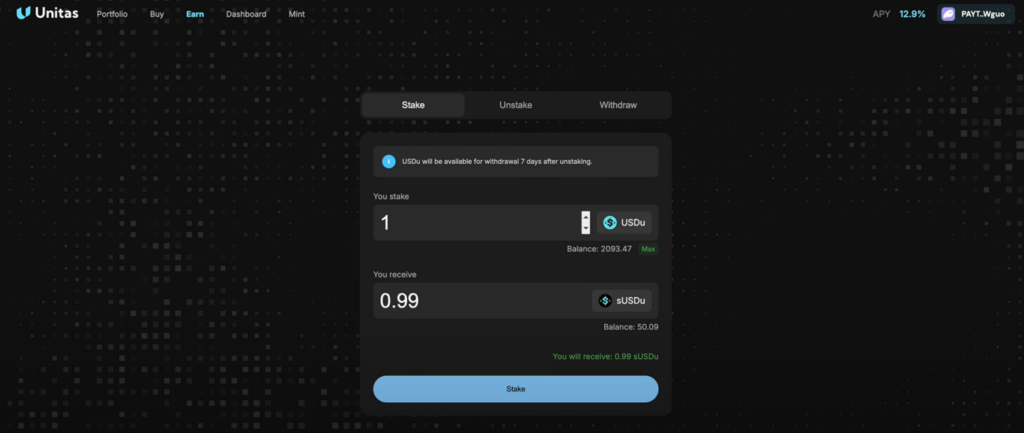

- sUSDu is a yield-bearing savings token minted by staking USDu, where its exchange rate increases over time as the protocol distributes fee carry, funding premiums and protocol income, allowing holders to accumulate yield automatically without manual compounding.

- The delta-neutral mechanism pairs long collateral positions with short perps to keep net market exposure near zero, enabling USDu to remain stable during volatility while scaling more efficiently than fully over-collateralised models that lock excess capital.

- Off-Exchange Settlement provides secure interaction with centralized liquidity by storing collateral in segregated custodial vaults while hedging on exchanges, giving access to deep liquidity without exposing user assets to exchange-level custodial risks.

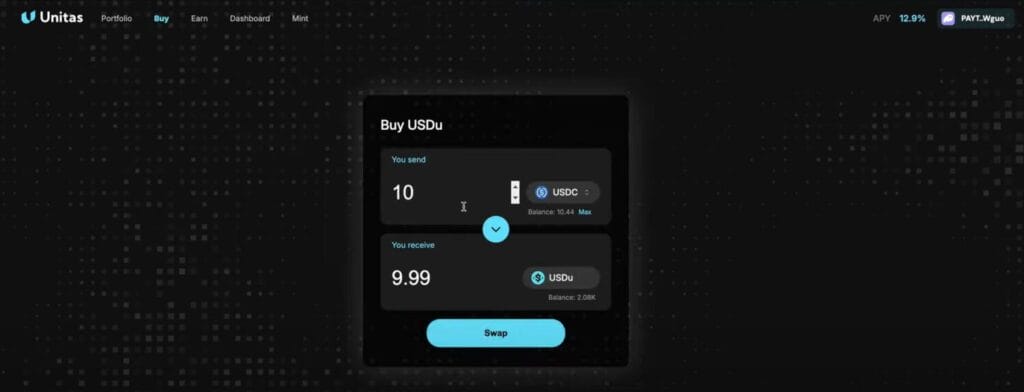

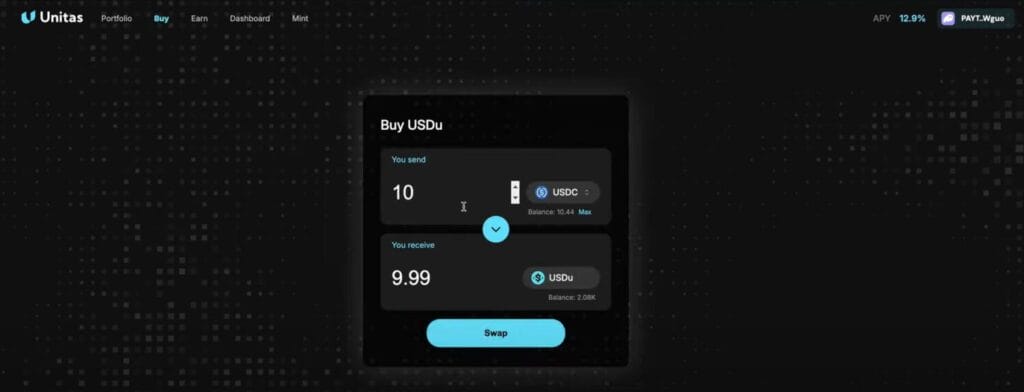

- Everyday users mint USDu by swapping stablecoins through the app interface, which automatically finds the best on-chain route and handles settlement, making access to USDu simple without requiring users to manage hedges or collateral instructions.

- Staking tools provide a streamlined dashboard showing balances, APY and yield progression, allowing users to lock USDu into sUSDu with confirmation prompts and immediate visibility of auto-compounding rewards after staking completes.

- The roadmap includes multi-chain expansion via bridging infrastructure, a spendable Unipay Card connected to USDu, and permissionless collateral adapters, positioning the system for broader adoption across DeFi and real-world payment environments.

Unitas Review: Fees

- Protocol-level fees are set to zero for core interactions such as minting USDu, staking into sUSDu, unstaking into the cooldown pool, withdrawing unlocked USDu and redeeming collateral, leaving users only responsible for minimal Solana network fees.

- Instead of user-facing fees, the system channels revenue from trading fees and hedging returns, distributing the majority directly to sUSDu holders while also funding an insurance pool and treasury functions that support system maintenance and buy-backs.

- Institutional minting and redemption do not impose static percentage fees; economic cost stems from hedging spreads, exchange settlement and RFQ execution, making the cost structure primarily dependent on market conditions rather than protocol tolls.

Security

- The system maintains high collateralisation ratios across SOL, ETH, WBTC, JLP and stablecoins while neutralising exposure through perpetual hedges, ensuring USDu remains backed even under fast-moving market conditions or major price swings.

- Custodial protection is provided through segregated MPC vaults operated by institutional custodians that never take ownership of user assets, allowing hedging access to centralized exchanges while keeping collateral securely stored off-exchange.

- Security layers include independent contract audits, a bug bounty program, redundant oracle feeds with fallback logic, automated risk-monitoring bots, margin-management safeguards, and real-time oversight of funding rates and rebalancing thresholds.

- The protocol is expanding its transparency architecture with proof-of-reserves systems that allow verification of collateralisation without revealing sensitive strategy details, improving trust while maintaining operational privacy.

Unitas Review: Mobile App

- The mobile experience mirrors the simplicity of the web interface, offering wallet connectivity, USDu swapping, staking and portfolio tracking in a streamlined layout that reduces friction for users who primarily operate on mobile wallets.

- Real-time balance updates, APY visibility, cooldown timers and yield tracking are integrated into a single view, allowing users to monitor both USDu and sUSDu positions with minimal navigation and immediate access to transaction actions.

- Mobile routing optimises stablecoin swaps and staking confirmations with fast Solana transaction times, ensuring a smooth experience comparable to standard mobile DeFi wallets while keeping user steps minimal and intuitive.

UI and UX

- The interface is designed with a swap-first flow where users select an input stablecoin, preview the result and confirm with one click, abstracting all complexity in the background so the minting process feels like a standard DEX swap.

- The staking dashboard displays balances, estimated sUSDu and APY clearly, with transaction messages and confirmation prompts guiding the user, followed by an automated yield display that increases without further interaction.

- Unstaking is split between initiating cooldown and completing withdrawal, with timers and status indicators showing exactly when funds are available; for urgent exits, built-in swap routes allow immediate conversion of sUSDu back to USDu.

Customer Support

- Users can access extensive documentation that covers protocol mechanics, minting logic, custody architecture, risk management, staking flows and detailed explanations of hedging strategies, reducing the need for external support.

- Transparency tools such as dashboards, transparency reports and portfolio trackers allow users to independently monitor collateral levels, hedge sizes, insurance funds and system activity without requiring direct communication with support staff.

- Additional assistance is available through public communication channels that includes X, Discord and Telegram.

Affiliate / Referrals and Rewards

- The protocol operates a points-based rewards program that tracks user actions such as holding USDu, staking sUSDu, adding liquidity or completing quests, and distributes seasonal rewards proportionally based on wallet activity.

- Referral rewards allow users to earn a portion of the points accumulated by invited participants, incentivising community expansion while reinforcing active participation in the protocol’s ecosystem.

- Liquidity programs provide additional APR boosts for users who lock USDu into approved partner pools, offering a combination of base yield and promotional rewards that increase overall return for committed participants.

- Combined, staking yield, point programs, partner boosts and referral rewards create a layered incentive model that benefits long-term holders and liquidity providers across the broader Solana ecosystem.

Data & Analytics

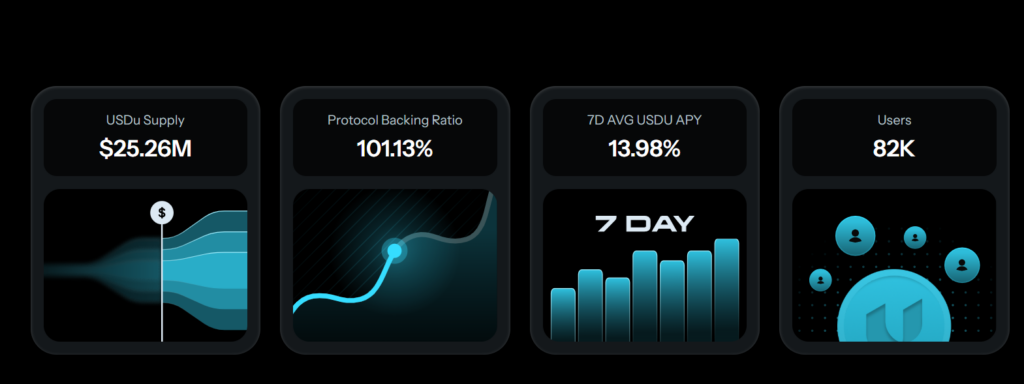

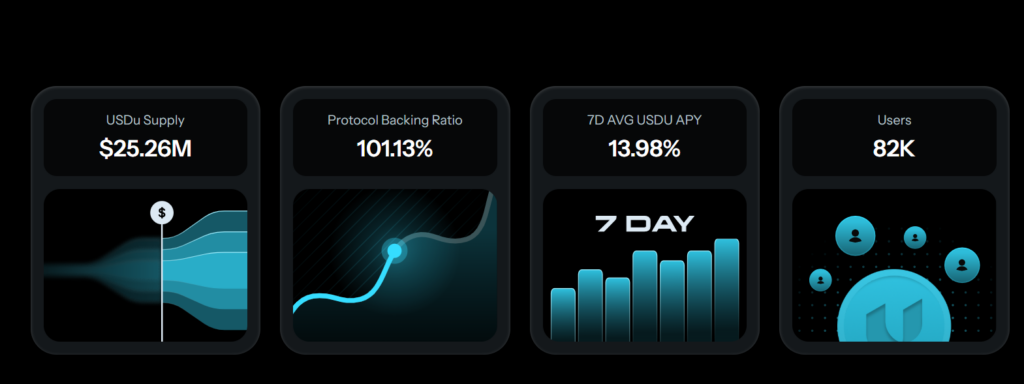

- Recent on-chain metrics highlight growing participation and strong engagement within the Unitas ecosystem. USDu has 914 current holders, while the yield-bearing sUSDu token has 650 holders, reflecting increasing adoption of both the base stable asset and its staking derivative.

- The Unitas Staking Pool Holdings stand at $22.26M, indicating substantial capital commitment from users seeking stable yield. Weekly performance metrics show $56,607 in rewards distributed, translating into a robust 13.98% weekly APY, which underscores the system’s ability to consistently generate and distribute returns to stakers.

- Total cumulative yield distribution has reached $624,502, demonstrating meaningful real returns flowing back to participants over time.

- Holder concentration data shows a diverse spread of balances, with the top wallet holding approximately 25.26M USDu, followed by others with sizable but progressively smaller positions, suggesting an emerging but maturing distribution pattern aligned with early-stage ecosystem growth.

- These indicators collectively point to expanding liquidity, sustained user activity, and strengthening economic foundations across the platform.

Unitas Review: Conclusion

Unitas delivers a stable, delta-neutral, yield-bearing digital dollar system that maintains USDu’s peg through over-collateralisation and hedging while directing the majority of fees and funding income to sUSDu holders as automated yield. Data from the protocol’s dashboards reinforces this stability, showing over $22M staked, nearly 1,000 USDu holders, and weekly rewards exceeding $56K, all contributing to strong user participation and compelling yield dynamics. A weekly APY of 13.98% and more than $624K in total yield distributed highlight the system’s efficienc31y and real earning potential. Unitas supported not just by its design principles but by measurable on-chain performance that signals strong long-term adoption potential.

Is USDu available to users outside the Solana ecosystem?

Can USDu be used for everyday payments or only for DeFi?

USDu is primarily used in DeFi today, but Unitas plans to introduce the Unipay Card, which will enable real-world spending. Until then, USDu payments depend on merchant integrations within the Solana ecosystem.

What happens to USDu stability during extreme market crashes?

The protocol is designed to remain delta-neutral, meaning hedges automatically offset collateral price swings. However, in extreme tail events, funding conditions or exchange liquidity may impact rebalancing speed, temporarily affecting stability.