Tether, the company behind the largest stablecoin USDT, has moved 8,889 BTC worth around $1 billion to its reserve wallet at the end of Q3 2025, according to on-chain data from Arkham Intelligence.

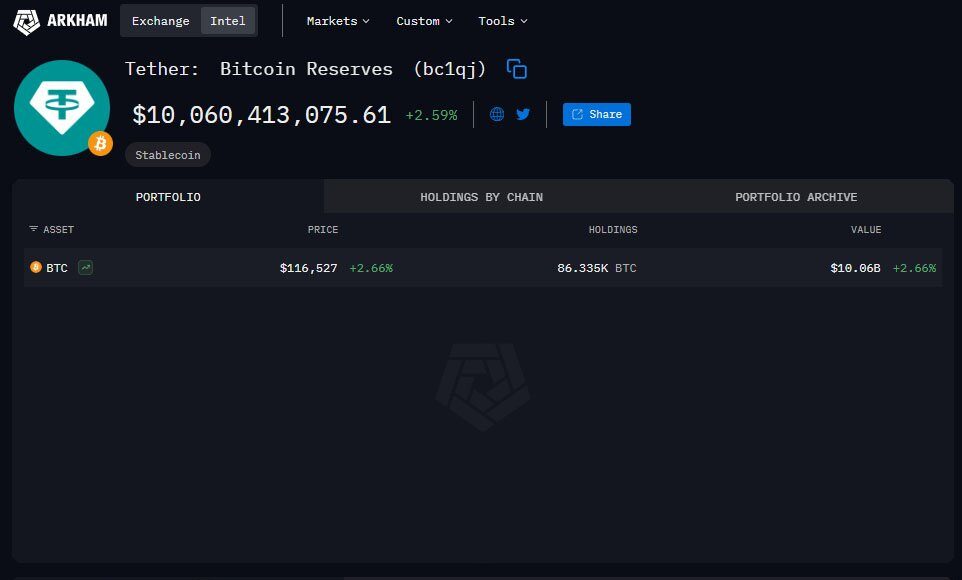

This latest purchase brings Tether’s total bitcoin holdings to around 86,335. At current prices, that’s over $10.1 billion, making Tether one of the largest corporate holders of bitcoin in the world, alongside companies like Strategy and Block.

This is a regular habit. Tether announced in May 2023 it would allocate 15% of its net profits into bitcoin. Since then, it’s been adding to its reserves at the end of each quarter.

CEO Paolo Ardoino replied “yeah” to a social media post tracking the purchase.

As with previous times, the bitcoin came from Bitfinex hot wallets and was moved into addresses tagged as Tether’s. Bitfinex and Tether are closely tied together, and for Tether, these transfers are just routine.

Tether is building a fortress balance sheet. Alongside bitcoin, it also holds around 7 tons of gold and more than $127 billion in U.S. Treasuries according to recent financials.

By anchoring its balance sheet in non-sovereign assets, Tether is trying to be more than just a stablecoin issuer. The strategy is to be resilient against inflation, sovereign debt, and market risks.

By keeping bitcoin with cash and other liquid assets, Tether is essentially betting that bitcoin will be a stable hedge over the long term.

While Tether is buying more bitcoin, its flagship stablecoin USDT is still the market leader. Data shows USDT supply is now at nearly $175 billion, making 59% of the global stablecoin market.

Tether is launching a new stablecoin called USAT to comply with U.S. regulations. Headed by former White House advisor Bo Hines, USAT will be issued under U.S. oversight with reserves managed by Anchorage Digital Bank and Cantor Fitzgerald.

This is Tether’s biggest challenge yet to Circle’s USDC which has been the leading U.S. regulated stablecoin.

Tether is also looking to raise one of the largest fundraising rounds in history.

Reports suggest they are looking to raise $15-20 billion in fresh equity for about 3% of the company. If successful, Tether will be valued at around $500 billion, making it one of the largest private companies in the world alongside SpaceX and OpenAI.

Financial analysts say Tether could be as profitable as Saudi Aramco. “(Tether could become) the most profitable company in history,” said Bitwise CIO Matt Hougan, citing the company’s access to global money markets and growing reserves.

100% of the sats go to the author