Speaking at the Abu Dhabi Finance Week on 10 December 2025, Michael Saylor said that Bitcoin is indeed digital gold and that once everyone understands it for what it is, the global credit is will be built on it.

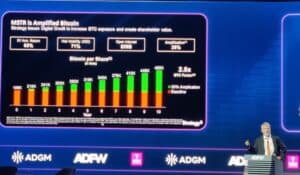

According to Saylor, Strategy is currently acquiring nearly $500 million to $1 billion worth of Bitcoin per week and has managed $60 billion worth of equities in the past 14 months, becoming the fifth largest treasury in the S&P universe, well on its way to becoming the largest in about four to eight years, given the same pace of accumulation continues.

According to him, the entire cabinet of the US, along with President Donald Trump, and financial as well as non-financial regulators, backs this idea. Moreover, major banks in America, including skeptics such as JPMorgan, Bank of America, etc., have started to warm up to the concept and are now extending credit on Bitcoin and Bitcoin derivatives.

JUST IN: Michael Saylor says he got approached by all the major banks recently to launch #Bitcoin products and services.

Banks are here

pic.twitter.com/AcHQRCaP7y

— Bitcoin Magazine (@BitcoinMagazine) December 9, 2025

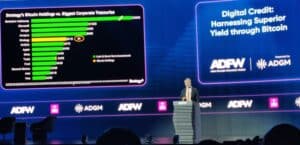

With all these Bitcoins amassed, Saylor says that Strategy has created the world’s first credit vehicle, generating $800 million in dividends, paying about 10% dividend rates by either selling equity, Bitcoin commodity, or derivatives in the public markets.

EXPLORE: Next 1000X Crypto – Here’s 10+ Crypto Tokens That Can Hit 1000x This Year

Michael Saylor: Bitcoin Is The Better Long-Term Investment

According to Saylor, Bitcoin is a better long-term investment than credit instruments. He believes the crypto gold will go up 30% a year for the next twenty years.

JUST IN: MICHAEL SAYLOR PREDICTS $BTC WILL GROW ABOUT 30% ANNUALLY FOR THE NEXT 20 YEARS

— BSCN Headlines (@BSCNheadlines) December 10, 2025

“We’re willing to give you the first 10% of that 30%, and we take the rest because over a decade, it means that we capture 80-90% of the economics, and then we will overcollateralize it with cash on a 5:1 or 10:1 collateral basis.”

He explained that the banks don’t really pay all that much, and the money markets only pay about 4%. Further, when the Fed (Federal Reserve) changes hands, it will pay about 3%, all of which is taxable to the investors, as opposed to Strategy doling out tax-deferred 10% dividends.

The big idea: digital credit built on digital capital. “The Investment Company Act of 1940 makes it impossible for a public company to capitalize on securities; you need commodities. Bitcoin is that commodity,” he said.

EXPLORE: 9+ Best Memecoin to Buy in 2025

“The World Is Built On Capital, It Runs On Credit”

Expanding on the idea of digital credit, Saylor differentiated between capital and credit. “If you give a three-year-old a million dollars worth of real estate in the middle of town, that’s capital. You have to wait 30 years to get rich, there’s no cash flow,” he said. “You could also give them $10,000 a month, that’s credit,” he added.

“Capital is the granite underlying New York City, credit is the buildings that generate rents, over the granite,” he concluded. He said that most people do not want capital, such as Bitcoin, which is volatile. What people usually want is a bank account that pays them 10% forever without the rollercoaster of ups and downs that inherently comes with Bitcoin.

This is where Strategy as a company comes in. Saylor explained that Strategy strips the risk by overcollateralizing 5:1 or 10:1 and then compresses the duration so that the end user gets instant gratification rather than waiting for a longer time frame.

Meanwhile, the company has rolled out some pretty bold products. One is STRK, a preferred stock that dishes out an 8% dividend and is backed by Bitcoin. The other is STRF, a perpetual bond offering a 10% yield, designed to fuel long-term investments in digital assets.

Saylor argued that investors who believe in digital credit should buy Strategy’s common equity, adding that he views Strategy as the central bank of Bitcoin.

EXPLORE: 20+ Next Crypto to Explode in 2025

Key Takeaways

- Michael Saylor calls Bitcoin digital gold and a foundation for global digital credit systems, backed by the US cabinet and Trump himself

- Strategy acquires $500M–$1B Bitcoin weekly, managing $60B equities in 14 months

- New products STRK and STRF offer 8–10% Bitcoin-backed dividends to investors

The post Michael Saylor’s Big Bitcoin Idea: Digital Credit Built Upon Digital Capital appeared first on 99Bitcoins.