LAB Terminal is the new trading ecosystem built for speed, precision and trader-control, designed to serve as a unified interface across browser extension, Telegram and web. In this article we will explore the LAB Terminal Review.

What is LAB Terminal?

- LAB Terminal is the first product of the broader LAB ecosystem, positioned as a full-scale trading terminal aimed at helping traders out-perform by offering high-performance execution, multichain integration and one interface across devices.

- The terminal is built “by traders, for traders” and tailored to give users access to sophisticated trading tools, custom presets, native wallet management, referral and loyalty programs, and browser extension + Telegram integration.

- It supports creating or importing wallets, selecting networks, depositing funds, executing trades, and withdrawing funds across supported chains – forming a true all-in-one trading interface rather than a simple exchange.

- LAB Terminal includes a browser extension that layers on top of existing platforms, a Telegram integration for quick trades, and future plans for mobile and multichain support, positioning it as a complete ecosystem rather than a standalone app.

- The ecosystem also includes loyalty airdrops (Season-1, Season-2) and referral programs as part of the user growth and reward structure, making trading activity itself eligible for downstream rewards and token allocations.

LAB Terminal Review: Features

- Lowest Commissions – LAB Terminal charges a 0.5% trading fee, which is roughly half the standard ~1% fee seen on many competitors, allowing users to retain a higher share of their trading profits across buy and sell orders.

- Professional Browser Extension – Offers full trading capability from within your browser toolbar, overlaying on top of existing analytics platforms. It detects token pairs automatically, places trades, and integrates with your current workflow seamlessly.

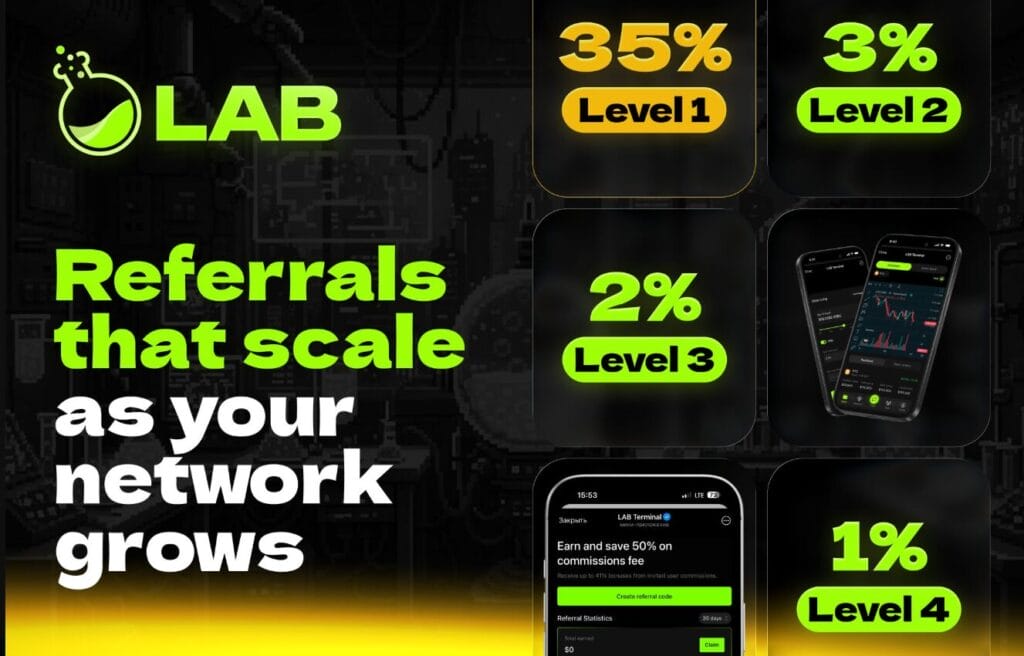

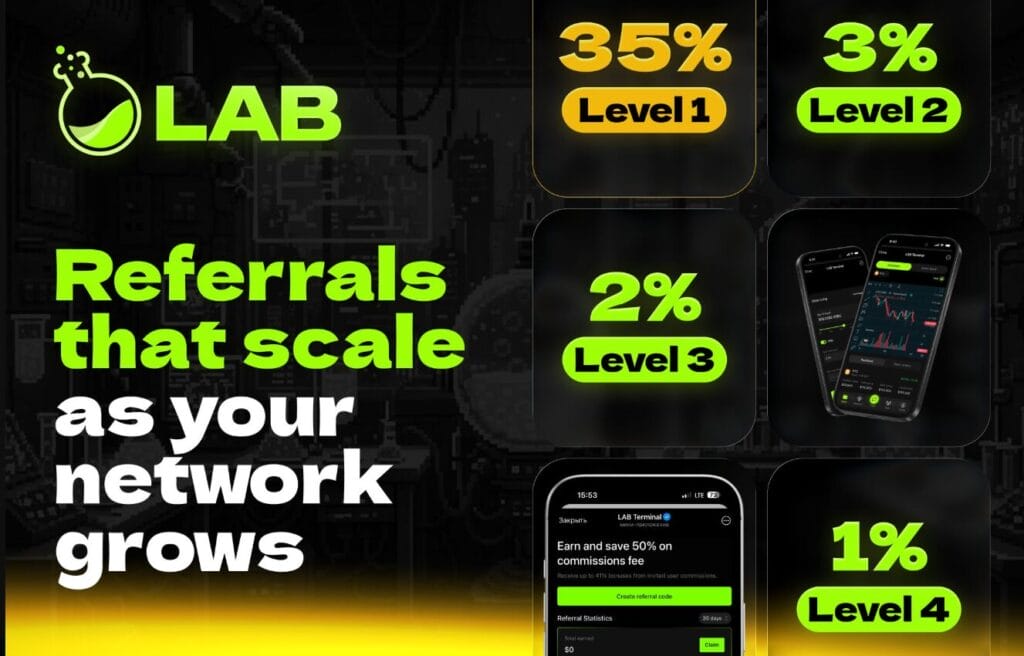

- 4-Level Referral System – Enables users to earn passive income by inviting others into the ecosystem. Rewards cascade across four levels of referrals, tapping trading volume from your network to generate revenue share.

- Multichain Native Support – While current support includes Solana and TON, LAB plans to expand to all major chains (including non-EVM) so traders can operate and execute across diverse networks from one terminal.

- Unique Trading Algorithms – The platform integrates proprietary algorithms that process data pre-display and deliver faster entry points and higher execution precision, enabling users to trade more quickly and accurately than many alternatives.

Boost Mode Execution – A specialized trading mode for ultra-fast buy/sell execution with customizable slippage, gas settings, and MEV protection. Designed for high-velocity trading and rapid market moves. - Trading Presets with TP/SL – Users can configure presets for Take Profit and Stop Loss, enabling automated exit strategies and custom workflows that match their trading approach without constant manual intervention.

- Wallet & Multichain Management – Allows creation or import of wallets, management of multiple wallets, network selection and fund deposits/withdrawals. Supports native tokens for each network and aligns wallet control with trading.

- Telegram Bot Integration – Offers trading from within Telegram, enabling order execution, monitoring, wallet sync and strategy control from mobile without needing a traditional mobile trading app per se.

- Loyalty Airdrop & Rewards Programs – Includes programs like Season 1 (historical trading-based) and Season 2 (active trading points) to reward user activity, trading volume and referral participation, driving long-term engagement.

LAB Terminal Review: Fees

- LAB Terminal promotes its 0.5% trading fee (buy & sell), positioning this as significantly below rivals (~1%) for both execution and cost efficiency.

- While specific fee tiers are not deeply detailed in the documentation, the “lowest commissions” highlight suggests a flat fee model rather than highly tiered structures.

- There may be additional cost layers for advanced features such as Boost Mode (premium execution settings) though detailed public fee sheets are not extensively published in the core docs.

- Referral commissions are treated as fee-sharing mechanisms: trading fees paid by users feed back into referral income for network participants, hence the platform encourages volume generation rather than just feature access.

Security

- While full deep security audits are not enumerated in the documentation, wallet control is built around non-custodial models: users import or create wallets and retain ownership, reducing centralized risk.

- The system emphasizes customized gas, slippage and MEV protection (in Boost Mode) especially for networks like Solana, indicating awareness of front-running, sandwich attacks and execution vulnerabilities.

- Multi-wallet support and wallet syncing suggest users can manage multiple addresses under one account; this requires robust authentication and safe key-management practices, though specific cryptographic details are not publicised.

- The documentation lacks detailed public audit disclosures in the sections accessed, so users should proceed with the usual caution for new trading terminals and ensure independent due diligence on smart contracts, network security and token economics.

LAB Terminal Review: Mobile App

- The documentation emphasises browser extension and Telegram bot integration rather than a standalone native mobile app; trading from mobile occurs via Telegram or browser rather than dedicated iOS/Android apps at present.

- Because the interface is optimized for browser extension + Telegram, mobile usage is accommodated via Telegram trading commands, wallet sync, and remote management rather than a fully native mobile GUI.

- For traders prioritising mobile-only workflows, this hybrid model may require comfort with extensions or Telegram rather than app store downloads; future native mobile app development may be referenced but not yet available in the core docs accessed.

UI and UX

- The platform emphasises “optimized UX/UI” especially in Boost Mode, offering simplified, streamlined workflows for rapid execution—less clutter, faster decision making, higher efficiency for high-velocity traders.

- The browser extension overlays seamlessly on top of existing analytics platforms, enabling traders to remain in their familiar workflow while gaining enhanced execution control — a design choice that prioritises integration over reinventing interface.

- Custom presets, order automation, stop-loss/take-profit templates and network selection features all contribute to advanced users’ ability to configure workflows rather than being forced into rigid layouts. The design supports both novices and pro users.

- The multi-device/Telegram support ensures that users can maintain continuity across desktop, extension and mobile Telegram interface, which helps reduce friction and learning curve for switching between devices.

Customer Support

- The documentation emphasises “Help Button” within wallet/wallet-management sections and onboarding guidance for registration, wallet creation/import and network selection, indicating in-interface support flows.

- While direct customer support channels are not deeply detailed in the “Unique Features & Benefits” or other sections accessed, onboarding steps (wallet import, network deposit instructions) are clearly documented, which helps reduce support burden for first-time users.

- Users should be aware that moving funds across multichain networks and managing keys inherently requires careful self-service; documentation helps, but real-time human support availability is not clearly stated in the sections reviewed.

Affiliate / Referrals and Rewards

- LAB Terminal features a 4-level referral system, allowing users to earn rewards across multiple tiers of their network and share in trading commissions generated by referrals, which incentivises community growth and user network effects.

- Loyalty programs include Season 1 – Loyalty Airdrop, which grants points and lootboxes for prior trading activity on certain platforms, enabling early adopters to benefit from historical volume by linking their wallets.

- Season 2 – Trading Airdrop focuses on current performance: every trade (buys, sells, limit orders) generates points, with no cap, and users climb leaderboards to unlock higher rewards and lootboxes—all convertible into the native $LAB token.

- Referral activity also ties into Season 2 rewards: by inviting others who then trade, you earn points and revenue share; leaderboard positions and network growth directly impact reward tiers and allocations.

- LAB Terminal shows strong cumulative activity with over one billion dollars in lifetime trading volume, supported by rising daily volumes and frequent volatility-driven spikes that indicate deep liquidity and sustained user engagement across market conditions.

- Platform-wide user metrics highlight more than fifty thousand lifetime users and nearly four million total trades, demonstrating broad adoption and consistent utilisation of automated trading tools, strategies, and execution infrastructure within the LAB Terminal ecosystem.

- Daily activity averages roughly 696 active users and over twenty-seven thousand daily trades, revealing a highly engaged user base that continuously interacts with the platform’s automated trading systems and maintains a constant flow of transactional throughput.

- Volume distribution across buy, sell, and fee components shows stable fee generation even during market pullbacks, illustrating the platform’s resilience and its ability to convert trading activity into predictable revenue for its operational model.

- Hourly and weekday activity patterns show concentrated trading clusters at peak market windows, suggesting users optimise bot execution around volatility cycles, which enhances trade density, improves liquidity efficiency, and increases fee generation across high-activity periods.

LAB Terminal’s analytics reveal a deeply active, high-volume trading environment that consistently supports millions of transactions and thousands of daily users. With over $1.2B in lifetime volume, more than 50,000 lifetime users, and strong fee-producing activity across buy and sell flows, LAB Terminal demonstrates robust platform traction and reliable liquidity conditions. These patterns show that the platform functions as a mature execution environment where automated strategies thrive. Together, these insights show LAB Terminal’s position as a scalable, high-performance trading ecosystem backed by sustained user participation, consistent fee generation, and stable operational throughput, making it a key liquidity engine.

Which networks can I deposit and trade on with LAB Terminal?

Currently deposits are supported on Solana and TON networks; stablecoins like USDT/USDC are not supported for trading in the available documentation.

Is there a standalone mobile app for iOS or Android?

How does the referral revenue share work?

Users earn a share of commissions from trading fees generated by their direct and multi-tier referrals through the 4-level referral system, enabling passive earnings through network growth.