Public policy group Infrawatch PH is calling on the Securities and Exchange Commission to strengthen anew its enforcement efforts against unlicensed crypto exchanges, citing persistent risks to investors from unregulated platforms.

Key details

- Infrawatch PH lauds the Strategic Surveillance and Enforcement Sandbox (StratBox) as a positive development.

- The group is urging the SEC to enhance enforcement measures that discourage unlicensed entities.

- Infrawatch highlighted the importance of public advisories and cooperation with the National Telecommunications Commission.

Infrawatch said that investor trust depends on transparency, accountability, and rule enforcement in the digital asset space.

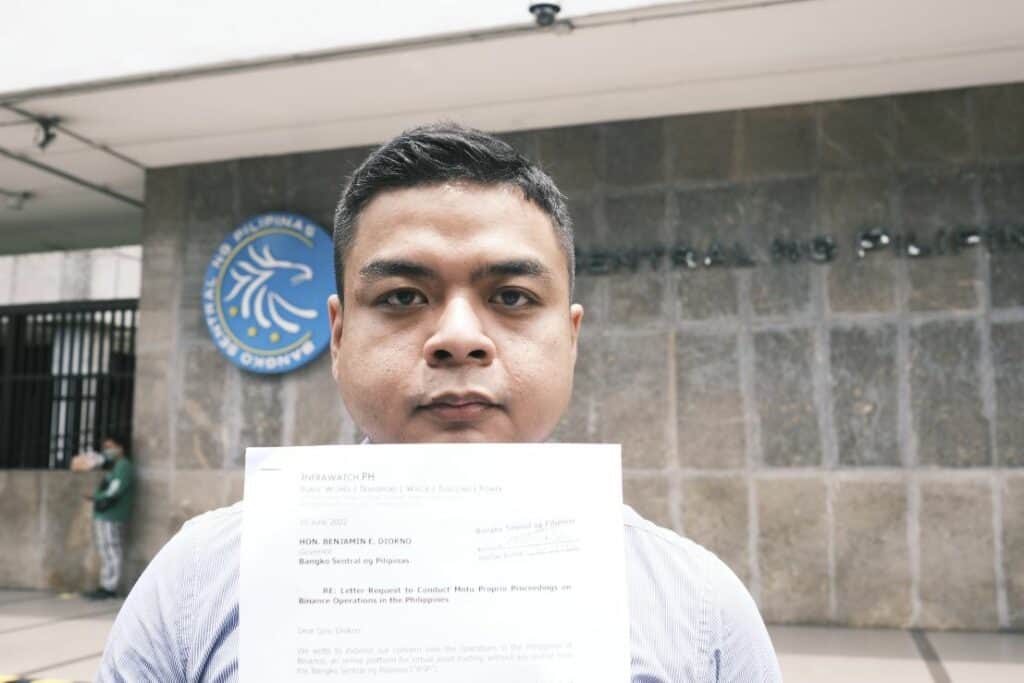

Initially, Infrawatch convenor Terry Ridon praised StratBox for promoting innovation among licensed crypto-asset service providers.

“The sandbox model supports innovation but only for regulated and licensed entities. The use of crypto for illicit activities remains rampant, particularly on unregulated and unlicensed firms, and the government should crack down on firms operating in the Philippine market.”

Terry Ridon, Convenor, Infrawatch PH

Reminder of Past SEC Enforcements

Infrawatch took this opportunity to remind regulators of past unregistered crypto platforms faced by authorities such as Binance.

The group warned those actions were necessary but insufficient without sustained efforts.

Ridon issued a direct call to the SEC to issue public advisories warning investors against unregistered platforms.

“If the SEC seeks strict compliance from licensed cryptocurrency exchanges, it should undertake stronger measures to crack down on unlicensed exchanges operating in the Philippines, particularly through advisories warning the public against investing in these firms.”

Terry Ridon, Convenor, Infrawatch PH

He said that unlicensed platforms often serve as channels for online scams and money laundering.

“Compliant players are subject to strict regulatory requirements, while unlicensed entities often operate with fewer restrictions, creating a distorted environment where non-compliance appears more profitable.”

Terry Ridon, Convenor, Infrawatch PH

Next, he said the resulting market conditions damage investor trust.

Finally, Ridon said further development of the crypto sector must remain firmly tied to strong legal and regulatory oversight.

“An emerging crypto environment should be regulated by the government to protect the public interest and investor funds while allowing innovation to thrive.”

Terry Ridon, Convenor, Infrawatch PH

The SEC recently released its final rules on Crypto Asset Services Providers. Read more about it on the links below:

This article is published on BitPinas: Infrawatch PH Urges Crackdown on Unlicensed Crypto Exchanges in Philippines

What else is happening in Crypto Philippines and beyond?