Hyperscale Data, Inc. (NYSE American: GPUS) has announced a new plan that combines two of today’s hottest trends: artificial intelligence (AI) and Bitcoin.

The company is launching a $100 million bitcoin treasury strategy while expanding its Michigan AI data center, becoming a pure-play AI and digital asset business.

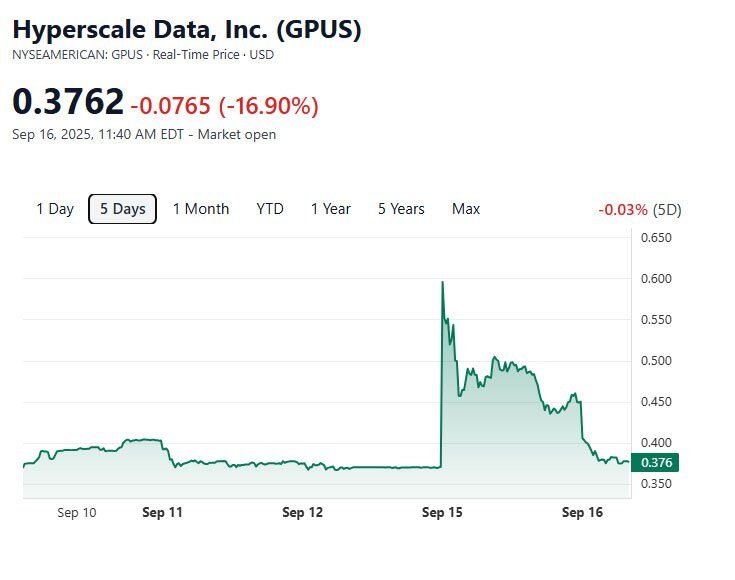

Hyperscale Data’s stock more than doubled in pre-market trading and increased as much as 101% on Monday morning before falling back down.

The plan will be funded by selling Hyperscale’s Montana data center assets and using its at-the-market equity program. By getting out of Montana, the company will focus on its Michigan campus and its bitcoin accumulation strategy.

The Michigan data center is at the heart of the company’s growth. Currently 30 MW, the facility will grow to 70 MW in 20 months with new natural gas infrastructure that will allow on-site power generation.

“This marks a pivotal moment in Hyperscale Data’s evolution,” said William B. Horne, Chief Executive Officer of Hyperscale Data.

“With the Michigan campus positioned to become an extremely valuable asset over time, and with Bitcoin now serving as a core treasury reserve, we are building a company anchored in two of the most dynamic forces of our era: artificial intelligence and digital assets.”

Through its subsidiary Sentinum, Inc., Hyperscale has been mining bitcoin for years.

The company has about 11 BTC, worth around $1.2 million. All of its bitcoin has been mined, not bought on the open market. This background, the company says, provides it with a foundation of operational expertise in digital assets.

Hyperscale will publish weekly updates on its digital asset holdings.

Hyperscale is following the Strategy playbook, which made bitcoin its primary reserve asset. The $100 million program will make one of the largest corporate bitcoin treasuries in the world.

Hyperscale already has digital assets equal to almost 12% of its market cap before the new treasury plan is even in place.

Industry experts say corporate bitcoin adoption is getting more crowded. Companies in the U.S., Europe, and Asia are building treasuries, but rising rates and volatility are making it harder to succeed.

Bitcoin doesn’t generate income like traditional assets, so companies must rely on price appreciation or operational strength to support their strategy.

Hyperscale Data is another example of struggling companies turning to bitcoin treasuries in hopes of opening new doors. The company’s stock has been on a downward trend despite several reverse stock splits. It has fallen from $5.82 to $0.45 in the last year alone.

Hyperscale thinks its focus on the Michigan AI datacenter, and adopting a bitcoin treasury, is what the company needs.

“By focusing our resources to accelerate Bitcoin accumulation while also expanding Michigan, we are pursuing a dual strategy designed to create long-term value for our shareholders,” Horne said.