Major cryptocurrencies barely flinched Wednesday, even as Federal Reserve officials delivered a contentious third consecutive interest-rate cut — a move that exposed unusually sharp divisions inside the central bank.

Summary

- The Fed delivered a highly contentious third consecutive rate cut, exposing deep divisions over inflation versus labor-market risks.

- Bitcoin and Ethereum barely moved, with crypto markets largely ignoring the central bank’s policy drama.

- Powell’s term ends in May, raising uncertainty about future rate direction as President Trump prepares to name a successor.

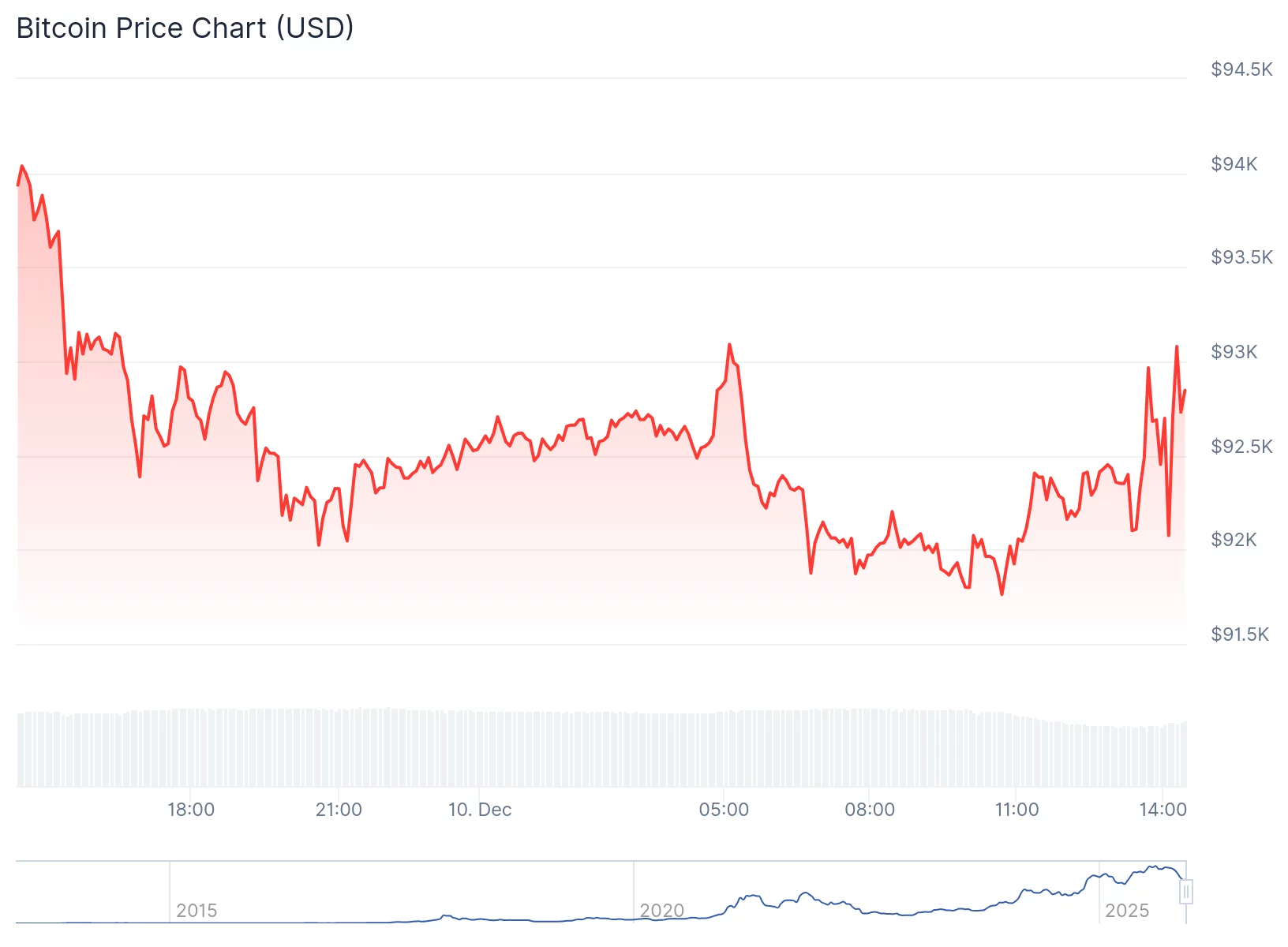

Bitcoin hovered at $92,902, up just 0.2% for the week and down 1.3% on the day, while Ethereum traded at $3,396, rising 0.7% on the day and 8.5% for the week.

In other words: markets largely shrugged while the Fed argued with itself. Historically, crypto prices typically decline during rate increases and rise during rate cuts.

At the center of the tension was a 25-basis-point rate cut that nudged the federal funds rate down to 3.5%–3.75%, the third cut in as many meetings — and the fourth straight vote without full committee support.

Public remarks in the weeks leading up to the decision already telegraphed deep fractures within the 12-member Federal Open Market Committee, leaving many analysts convinced the outcome came down to one person: Chair Jerome Powell.

Powell’s term expires in May, giving him only three more rate-setting meetings before President Trump appoints a successor. The looming transition is raising questions about how unified — or unstable — the Fed’s policy direction may become.

Inside the committee, two opposing camps have hardened:

• Inflation-focused hawks warn the Fed is cutting too soon into an economy that may be sturdier than it appears. With inflation running above target since 2021, they fear rates may no longer be restrictive enough to push prices down.

• Labor-market doves say the opposite: housing and jobs remain soft, and they see scant evidence that cheaper borrowing is reviving demand. Their concern is asymmetry — if unemployment suddenly accelerates, the damage could require far more aggressive intervention than if inflation simply lingers near 3%.

For now, crypto traders seem to be tuning out the drama. But with a split Fed, a ticking clock on Powell’s term, and a still-murky path for future cuts, the calm may not last.