Ethereum is trading around $2,770. The asset has pulled back from recent highs and appears to be in a consolidation phase, influenced by broader market weakness and reduced momentum across crypto markets.

For on-demand analysis of any cryptocurrency, join our Telegram channel.

ETH Next Target

- Price: $2,770

- Circulating Supply: Approximately 120.7 million ETH

- Total / Max Supply: No fixed cap

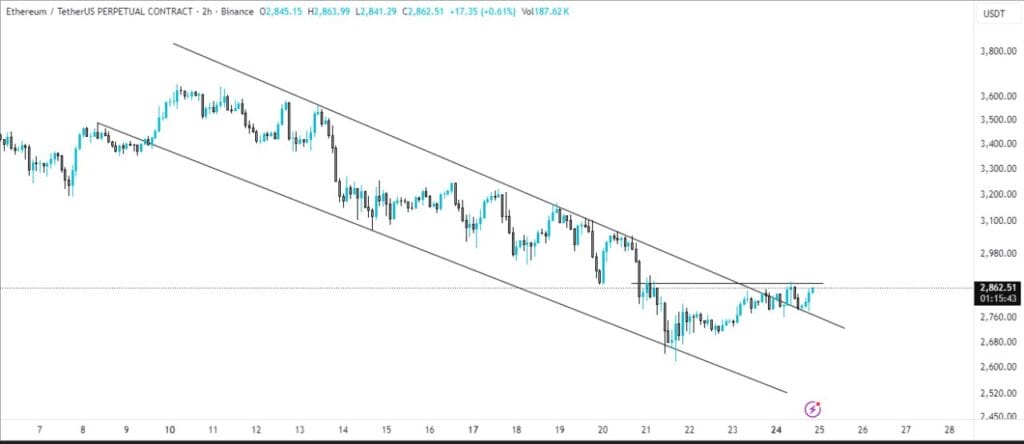

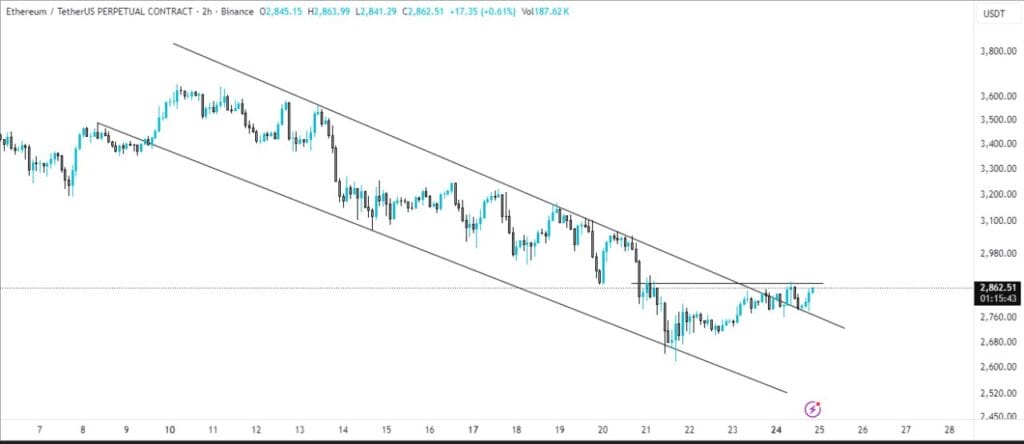

The price has broken the descending channel, and the breakout of the horizontal resistance trendline will provide a bullish trend.

Key Indicators & Market Signals

- ETH is holding support near $2,750–$2,800.

- Resistance lies around $3,000–$3,100; a break above may reignite bullish momentum.

- On‐chain metrics remain solid: staking remains elevated and network usage is consistent.

- The pullback appears driven mainly by macro factors and profit‐taking rather than weakness in protocol fundamentals.

Latest News Highlights

- Analysts note that Ethereum’s current price may be reflecting broader risk‐off sentiment more than a change in fundamentals.

- Institutional interest remains evident, but net inflows have slowed, indicating cautious capital deployment.

- Infrastructure upgrades and Layer-2 activity continue on schedule, offering long-term positive tone.

Summary

Ethereum trades near $2,770, with support at $2,750–$2,800 and resistance near $3,000–$3,100. If ETH breaks above resistance, it could target $3,300+; failure to hold support may lead to a retest of lower zones.

Despite the recent pullback, Ethereum’s ecosystem remains one of the strongest in crypto, and its long-term outlook is still anchored in staking, DeFi usage, and network growth.

For on-demand analysis of any cryptocurrency, join our Telegram channel.