If you’ve ever bought Bitcoin or any other crypto, held it for months, and waited for that perfect exit – you’re not alone. That’s how most of us started. But the market doesn’t always move in upward trends. Over the years, more traders have been exploring crypto FnO to manage risks, stay active in sideways markets, and build more structured strategies.

This shift has pushed crypto derivatives exchanges to rethink their approach. Delta Exchange has been part of that transformation – building tools around how traders actually trade. As India’s largest crypto derivatives exchange, it’s become a go-to for those looking beyond simple buy-and-hold setups.

In this blog, we’ll look at what Delta offers and how it supports your trading styles and investment goals.

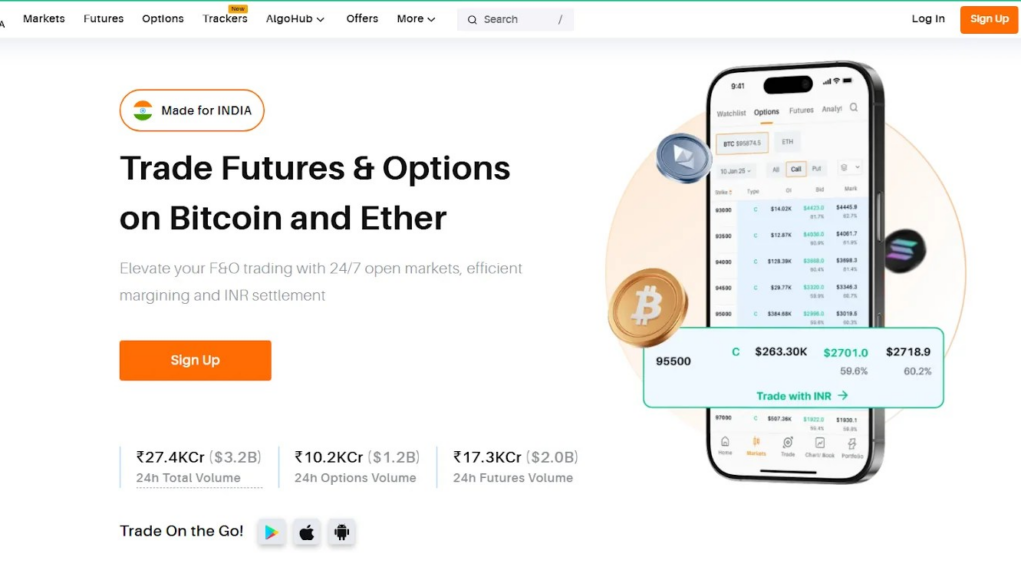

A Brief on Delta Exchange

For traders stepping into crypto FnO trading, choosing the right platform isn’t just about low fees or advanced features – it’s about trust, compliance, and ease of use. Delta Exchange was built to meet those expectations head-on. As one of the top crypto derivatives exchanges, it allows you to trade crypto derivatives contracts on Bitcoin (BTC), Ethereum (ETH), Ripple (XRP) and more.

Source | Delta Exchange for safe crypto FnO trading

You don’t need to own crypto or convert currencies to participate in the market – which means full FIU-India compliance, INR deposits and withdrawals, and a structure designed under local regulations. The platform sees over $3 billion in daily trading volume, with features like portfolio margin and small lot sizes making it accessible for both new and experienced traders.

If you’re interested in trading crypto derivatives, Delta offers a compliant space to get started.

Why’s Delta Exchange Different From Other Platforms

What sets Delta Exchange apart from the other indian crypto exchanges is its ability to simplify complex trades for all traders. You can test a basic trade or build multi-leg strategies – the tools are designed for clarity and safety.

Source | Trading crypto derivatives (options) on ETH

One of Delta’s most used features is its strategy builder, where you can try out advanced setups like ratio spreads, long straddles, or short call/put options, without needing to code. It’s a visual interface where each leg of a strategy is laid out clearly, with a payoff chart, breakeven points, and potential losses or gains before execution, making it useful for traders who want more control.

The crypto derivatives exchange also supports automated trading bots – customized with entry/exit parameters and used across perpetual and futures contracts. Whether you’re hedging or just trying to run trades while away from the screen, bots offer hands-free support.

High leverage is available on most contracts, giving you more exposure with less capital. Say you invest ₹2,000 to trade ETH with 100x leverage – this gives you control over a ₹2,00,000 position. If ETH moves in your favor, even small price changes can bring high returns. That said, the risk is also high. If the market moves against you, it can lead to losses just as fast.

If you’re still figuring things out, the demo account lets you test crypto FnO trading strategies without using real funds or deposits. It mirrors the live market environment, so you can practice without risking real money.

- Affordable crypto derivatives lot sizes

Another plus is the small lot sizes. You can start trading crypto FnO with as little as ₹2,500 and ₹5,000, depending on the asset. It’s ideal if you’re looking to start small while learning how futures and options work in real time.

Altogether, Delta Exchange brings advanced trading tools into a setup that feels more accessible and safe.

Final Thoughts: The Road Ahead for Crypto FnO

With the ongoing innovation in the blockchain and crypto sector, the crypto FnO market is also shifting fast. Traders today seek more flexibility, lesser risks, and diversified assets. As institutional interest grows, platforms are expected to offer efficient execution, cleaner compliance, and strong infrastructure.

Delta Exchange stands at the forefront of this growth – combining INR-settled contracts, daily to monthly expiry options, and API access for automated strategies. By removing crypto custody challenges and allowing INR transactions, Delta is shaping what a modern crypto derivatives exchange should look like.

Download the Delta Exchange app and start trading crypto derivatives in simple steps. For more information, visit the website or join the community on X for all the latest updates.

Disclaimer: Crypto trading carries inherent risks due to its high volatility. This article is for informational purposes only. Kindly do your own research before investing.