After the massive success of its iShares Bitcoin Trust (IBIT), which now controls about 60% of the U.S. bitcoin ETF market, BlackRock, the world’s largest asset manager, has filed to launch a new product called the iShares Bitcoin Premium Income ETF.

This fund is different from BlackRock’s previous spot bitcoin ETF. Instead of just tracking the price of bitcoin, this new product will generate income for investors.

It does this by selling options, such as covered calls, on bitcoin or bitcoin futures, and then distributing the collected premiums to investors as regular payouts.

As Bloomberg ETF analyst Eric Balchunas put it, “This is a covered call Bitcoin strategy in order to give BTC some yield. This will be a ’33 Act spot product, sequel to the $87b $IBIT.”

The iShares Bitcoin Premium Income ETF basically uses bitcoin’s volatility to create income. Instead of just betting on whether bitcoin’s price will go up, the fund “rents out” its bitcoin exposure by selling options contracts.

Here’s how it works.

Imagine the fund holds one bitcoin worth $112,000. It then sells a call option with a strike price of $118,000. The buyer of the option pays the fund a premium—say, $3,000—for the right to buy bitcoin at that strike price.

If bitcoin stays below $118,000, the ETF keeps both the bitcoin and the $3,000. If bitcoin rises above $118,000, the ETF still gets the $3,000 but gives up gains beyond that price.

This means investors get regular payouts but their upside is capped when bitcoin rallies. The trade-off appeals to a different group of investors—those who want cash flow rather than just exposure to bitcoin’s price moves.

BlackRock says the product is for income seekers, conservative investors, and institutions that prefer steady returns over bitcoin’s wild price swings. “Investors are looking for ways to benefit from Bitcoin while minimizing price volatility,” the company said in a statement.

This new ETF is not meant to replace IBIT but to complement it. IBIT mirrors bitcoin’s price directly, while the Premium Income ETF is designed to generate yield. Together, they offer investors a choice between growth and income strategies.

Some say this could also make bitcoin more institutionally palatable for pension funds or insurance companies that need regular cash flows.

BlackRock’s involvement in digital assets has been rapid. IBIT, its spot bitcoin ETF, has pulled in over $80 billion since its launch in January 2024.

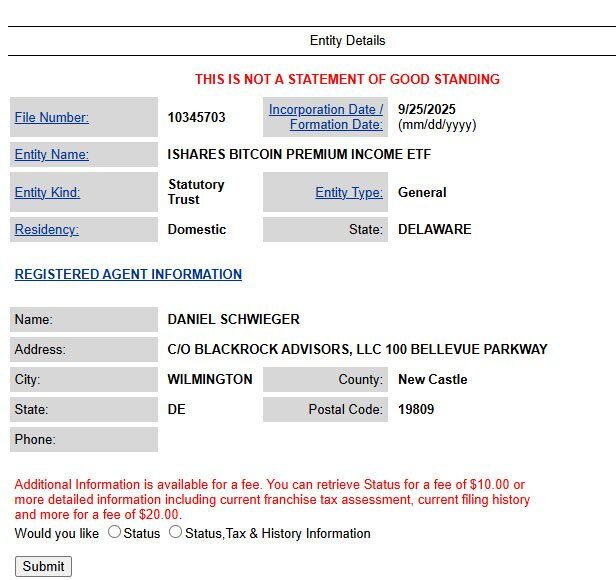

Like many of its ETFs, BlackRock filed in Delaware. The state is popular for financial institutions due to its business-friendly regulations and tax advantages. Industry analysts say Delaware’s flexible legal environment helps speed up approvals and builds trust with investors.

100% of sats go to the author