The Bitcoin price bounced emphatically off support at $60,000 in the first strong signal of bottoming activity, after giving up all of its Trump rally gains – but is it Trumpism in crypto that is at the root of crypto’s ills?

There’s certainly more hope in the air as the European session opens this morning, with Bitcoin trading above $66,400.

But all the factors that created the crash are still very much in play. Crypto leverage, crowded tech trades, high-risk asset correlation and Bitcoin narrative doubts are all in the bear market mix.

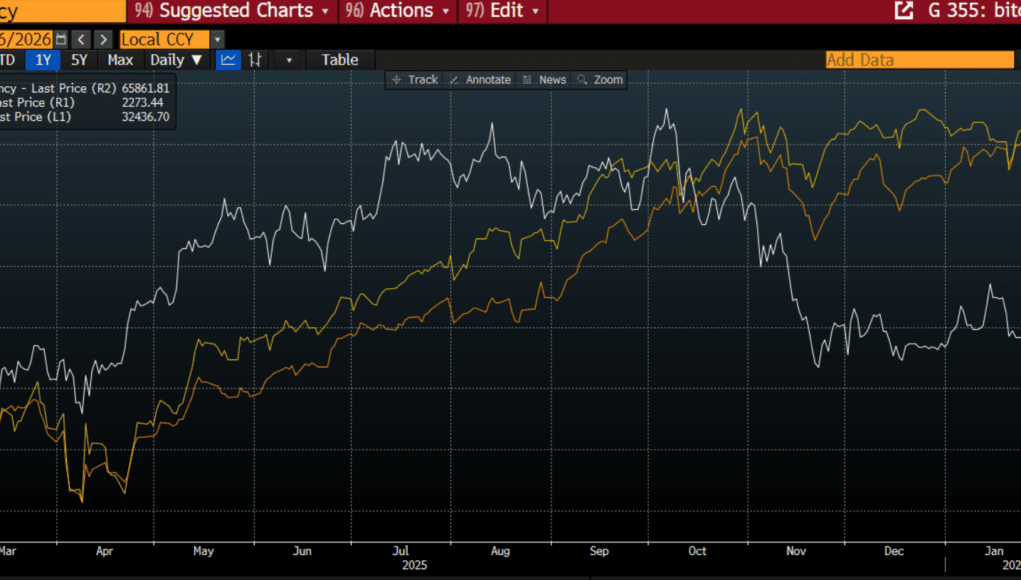

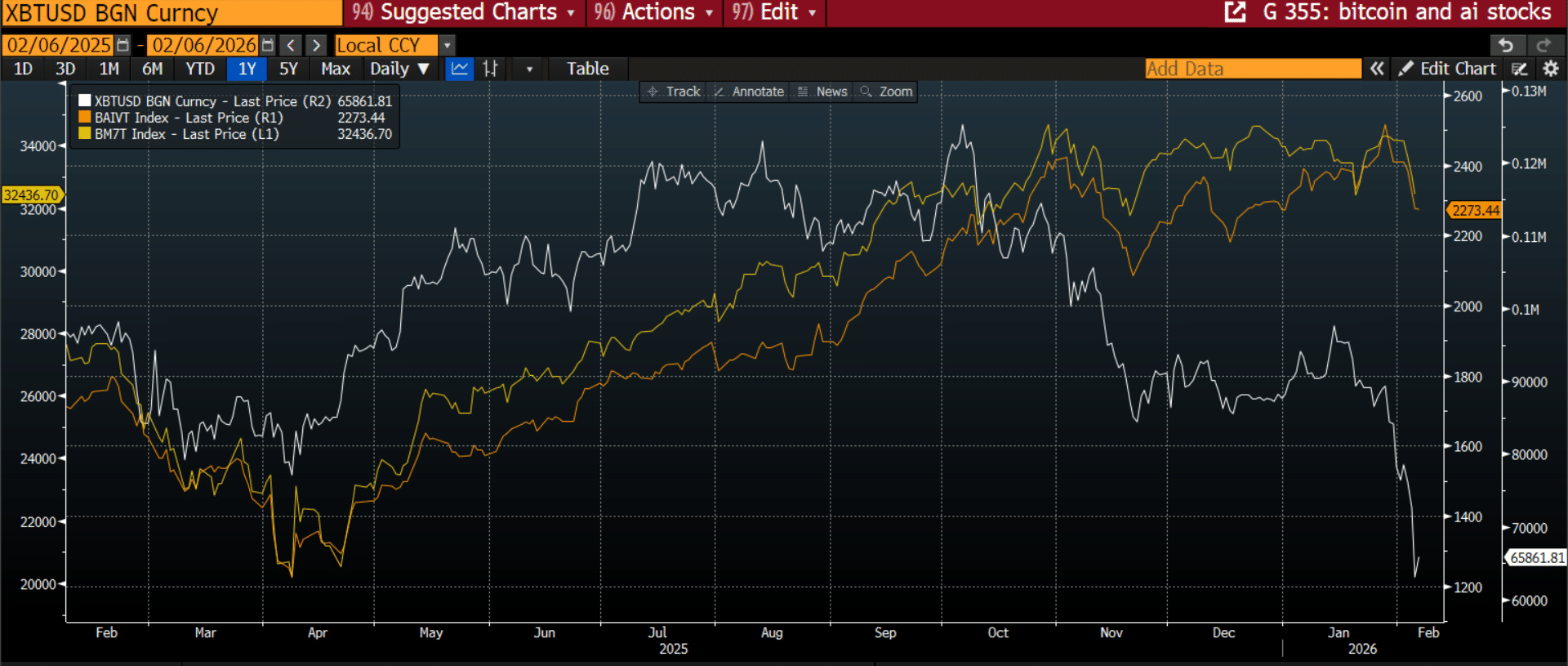

Fire up your Bloomberg terminal and create a chart to show the correlation between Bitcoin (XBT/USD), The Magnificent 7, tech stocks (BM7T) and the Bloomberg AI Value Chain Total Return Index (BAIVT) and you will see the following (thanks to Kathleen Brooks, research director at brokerage XTB):

Brooks explains what’s going on here: “The sell-off in bitcoin is also interesting, as bitcoin and the Nasdaq tend to move together, and their positive correlation is 40%. This is a moderate positive correlation, however, the correlation between bitcoin and Bloomberg’s basket of AI stocks have a closer positive relationship, at 62%.

“This suggests that when Bitcoin moves, it has an impact on AI stocks. The reason for this is liquidity. In recent years, liquidity has flowed across digital assets and advanced tech stocks at the same time. This means that both asset classes share a tight financial link, which is impacted by shifts in liquidity patterns.

“So, when bitcoin gained strength, this flowed into AI stocks, and when the price of bitcoin falls, this downside pressure can weigh on tech stocks.”

But what about the Trump factor? I asked Brooks for her take: “I think that the Trump family’s crypto interests are grubby, but I don’t think that is the main reason for investors deserting crypto in recent months.

Billionaire GOP Donor Ken Griffin Criticizes Trump Administration For ‘Enriching’ Family Membershttps://t.co/04YcnBglX5 pic.twitter.com/xbz9zrRJAR

— Forbes (@Forbes) February 4, 2026

“I think Trump’s policies, his threats to take Greenland by force, ditching his allies, and threatening Fed independence are actually hurting the environment for crypto.

“Crypto still has very limited uses, so when the geopolitical outlook/order is upended by a US President with an America First agenda, this makes it even less attractive to hold.”

Brook then turned to what she sees as the technical factors at play: “In the past few months, investors have been very wary of assets that have reached record highs, crypto was the first asset where valuations looked stretched and investors sold their stakes, wth few buyers to pick up the dip.

“This is happening with silver now and to a lesser extent with gold. Thus, the sell-off in crypto is part of a market-wide event with traders and investors reassessing valuations and how much risk they are willing to hold in richly valued assets.”

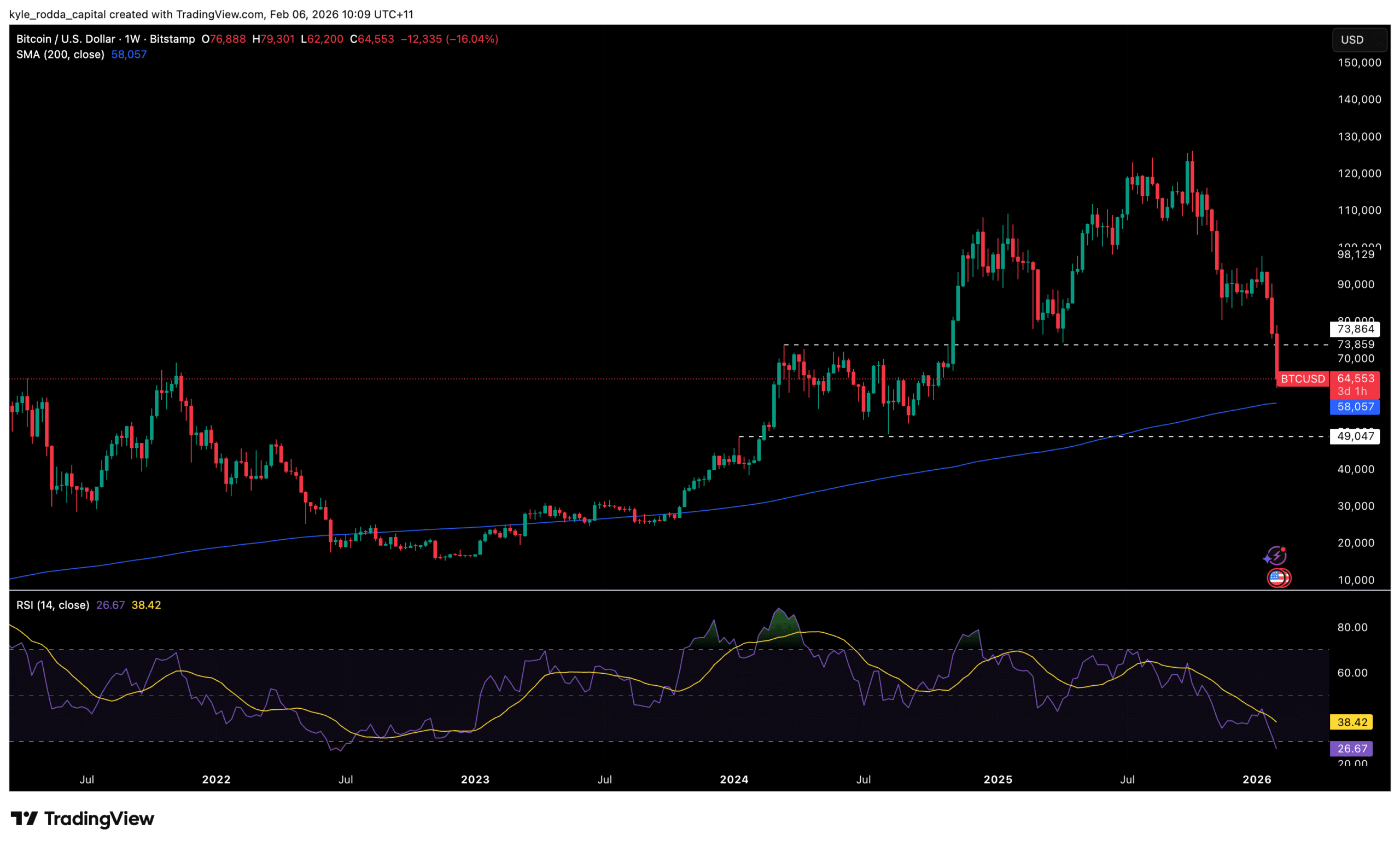

Bitcoin needs to hold above $58,000 and $60,000

At the end of the Asia session, Allen Ding, head of research at the Hong Kong-licensed virtual asset manager Bitfire, issued a note outlining the market’s precarious state heading into the weekend.

He thinks if Bitcoin doesn’t hold $60,000 or $58,000, a deeper correction is on the cards.

“Technically, Bitcoin accelerated its decline after breaching the key $74,000 support. While oversold conditions hint at a short-term bounce, focus shifts to the weekly EMA240 and the $60,000 level as the next critical support,” Ding explains.

He concludes that we are witnessing the unravelling of the supportive sentiment around high-risk assets. He comments, “A severe shake-up in global risk assets, with silver prices collapsing and Korean stocks alongside the Nasdaq tumbling.

“Fed expectations shifted, prompting a broad retreat from risk assets, while Bitcoin ETFs saw sustained outflows, Coinbase’s negative premium widened, and institutional bids weakened.

A wave of liquidation from leveraged Ethereum, amplified by programmed stop-losses, triggered a selling cascade.”

Chart: Bitcoin/USD Feb 5th 200-day SMA – Thanks to Kyle Rodda, Senior Financial Market Analyst at Capital.com.

DISCOVER: 20+ Next Crypto to Explode in 2026

Fed worries shift, Citadal Securities breaks cover on Trump

Let’s pull out the part Ding mentions about the Fed pick – ‘Fed expectations shifted’ may prove to be the understatement of this quarter. Kevin Warsh was in the list of likely contenders, but his selection has nevertheless injected yet more uncertainty into the macro environment.

Warsh was previously seen as a hawk. So, if his “I’m a low rates guy” ingratiation strategy with President Trump proves to be paper-thin and he starts running down the Fed’s bloated balance sheet, that’s not accommodative of an expansionary scenario. Trump’s plan is to throw money at the voters in the lead-up to the November midterms.

And that brings us back to the Trump Midas touch in reverse that no one wants to talk about, or at least, not out loud.

One of my sources at Citadel Securities recently told me that egrets were emerging about the Trump administration. Citadel is one of the biggest market-makers on Wall Street, and its boss, Ken Griffin, is a major Republican donor.

His company was behind the setting up of EDX Markets in 2023 and later moved into crypto market-making at the beginning of last year, taking its cue from the incoming administration’s avowed crypto-friendliness.

Although Griffin thinks Warsh will be a “solid” Fed pick that puts to bed worries about Fed independence, he is not so sure about everything else the Trump White House is up to. According to Bloomberg, Griffin broke cover at a recent Wall Street Journal event:

Citadel’s Ken Griffin said the Trump administration’s tendency to reward loyalists doesn’t play well with business executives and criticized the president’s willingness to enrich his family while in office.

“Most CEOs don’t want to find themselves in the business of sucking up to one administration,” Griffin said in an interview Tuesday at a Wall Street Journal event. When the US government “tastes of favoritism,” executives worry they could win or lose based on whether they publicly support the administration, he added.

At a minimum, the Trump family’s ‘grubby’ interests are not helping crypto

Although Brooks does not buy the line that it is all Trump’s fault, she does agree that the administration’s actions and the Trump family’s “grubby” dealings aren’t helping against the backdrop of more consequential market-moving developments.

If there is one description that, for many, sums up the Trump brand, it is grifting, and the danger is that it has rubbed off on crypto.

Businesses need state structures they can trust to be fair and even-handed when adjudicating between competitors in the market. Crypto needs to rebuild faith in its narratives or establish use cases that achieve the same outcomes. If crypto is seen as a way for the Trump family to enrich itself at the expense primarily of retail investors, it will leave a bitter taste in the mouth.

Delivering a CLARITY Act that really works for crypto and all market participants, and the emergence of killer apps, with Polymarket’s prediction market perhaps the first, could start to change it up in a more positive direction for crypto.

In the meantime, the leverage needs to be expunged and the market structure repaired, which in part requires Trump to pipe down – at the beginning of the week, he remarked that he was “a big crypto person” – and for his crypto companies to disappear. Brutal, but here we are. Enough already.

The post Bitcoin Price Crash – Is it All Donald Trump’s Fault? appeared first on 99Bitcoins.