More and more investors are speaking out against what they see as excessive pay for executives at U.S.-listed bitcoin mining companies.

New research from VanEck shows that executive compensation at major U.S.-listed bitcoin miners has increased by 115%, and shareholders are pushing back on concerns of dilution, governance, and lack of performance alignment.

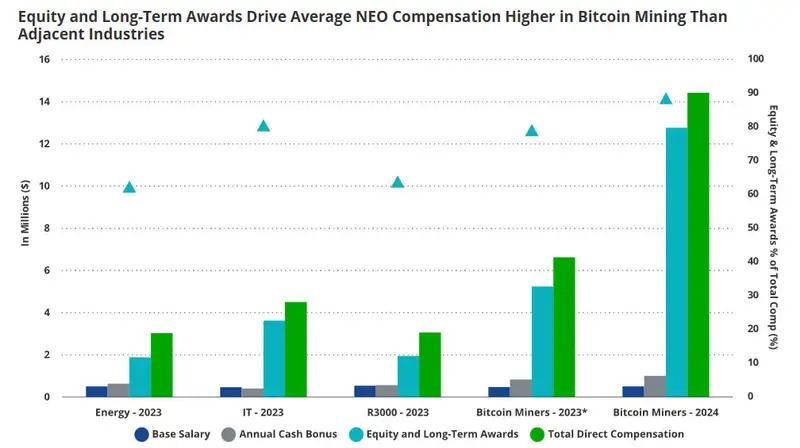

According to VanEck’s research, average executive pay at these companies went from $6.6 million in 2023 to $14.4 million in 2024, with 89% of total executive pay coming in the form of stock or other long-term equity instruments in 2024, up from 79% in 2023.

While stock packages are common in high-growth industries, investors are getting worried about compensation plans that seem loosely tied to company performance.

“Mining executives continue to grant themselves oversized equity awards that dilute shareholders without reliably linking pay to long-term value creation,” wrote Matthew Sigel, Head of Digital Assets Research at VanEck and Nathan Frankovitz, investment analyst at the firm.

Shareholders aren’t staying silent. Average support for executive pay at the 8 bitcoin miners studied by VanEck has dropped to 64% – well below the 90% average for companies in the S&P 500 and Russell 3000.

At three of the largest companies – Riot Platforms, Marathon Digital (MARA) and Core Scientific (CORZ) – disapproval was especially strong.

Say-on-pay votes failed at all three companies during the 2025 proxy season, with approval rates of 32% for Riot, 22% for Marathon, and 38% for Core Scientific.

VanEck notes that 6 out of 8 companies missed the 80% approval threshold that proxy advisor Institutional Shareholder Services (ISS) considers “low support”. That’s a 75% failure rate compared to 4% for the broader Russell 3000 index.

The most egregious pay package was at Riot Platforms, one of North America’s largest publicly traded bitcoin miners.

According to the report, Riot’s CEO got $79.3 million in equity in 2024 – more than double what Marathon and Core Scientific’s CEOs received, and several times the average pay of CEOs in the energy and tech sectors.

This isn’t new. In 2022, Riot shareholders voted against the company’s executive pay plan after the company disclosed $22 million in CEO compensation.

In 2024, Riot’s executive compensation was 72.8% of the company’s market cap growth – a huge red flag for a lack of alignment between pay and shareholder returns.

TeraWulf and Core Scientific awarded executive compensation that was 2% of their market cap gains and Marathon’s was 18%, showing much better alignment in those cases.

Bitcoin miners say their compensation practices are necessary to attract and retain talent in a fast-moving and technical industry.

Equity awards are a big part of that. But critics argue short vesting periods and “as-achieved” milestones encourage short-term thinking and leave shareholders with no protection against dilution.

Base salaries for executives were somewhat more reasonable—$474,000 on average—but stock grants went through the roof. Some companies expanded their equity plans by as much as 10% of their outstanding shares, which has investors worried about insider dilution.

VanEck warns that large pools of reserved shares can lead to big dilution for existing shareholders when stock awards are granted and vest over short periods.

On the plus side, six of the eight companies have now adopted performance stock units (PSUs)—a type of equity that only vests if specific performance goals are met, such as share price targets or total shareholder return. That’s up from two companies in 2022.

But VanEck says there’s more work to be done. Many companies still use short vesting timelines and uncapped bonus structures, and some—like CleanSpark and Bit Digital—haven’t implemented PSU-based compensation yet.

To regain investor trust, VanEck recommends that bitcoin miners:

- Link bonuses to cost-per-coin-mined to promote operational discipline

- Tie equity awards to capital efficiency metrics like return on invested capital

- Extend vesting periods and cap awards to minimize dilution risk

“As Bitcoin miners mature into large-scale infrastructure operators, their executive compensation programs must evolve as well,” VanEck’s researchers concluded.