Why is crypto up today? Exciting? Bitcoin price jumped higher after US inflation data came in softer than expected, and for a while, BTC has been looking ugly as the bear market began being the hot topic. Then it didn’t. Buyers stayed, sellers backed off. By the time New York opened, the Bitcoin price had already run, leaving Wall Street behind.

Ethereum price followed with a clean 7% jump to above $3,300, and suddenly the market woke up, the sentiment turned extra bullish, and the fear and greed index ran from fear to neutral. What looked like a routine an hour earlier turned into a full momentum shift, and the bull run is coming back!

–>

Crypto Fear and Greed Index

Fear

<!–

<!–

–>

Extreme

Fear

Fear

Neutral

Greed

Extreme

Greed

<!—->

Why Crypto Up? Bitcoin Price Moves Fast

The first real driver behind why crypto is up was positioning. Bitcoin price reclaiming $94,000 forced us not to think. Short positions started to unwind as liquidations kicked in, squeezing bears. Close to $600 million in shorts were cleared in a single day, with Bitcoin price accounting for the bulk of the damage.

(source – CoinGlass)

Macro data gave the market permission as US core inflation eased slightly in December, while job growth slowed more than forecast. This combination brought talk of rate cuts later on and weakened the dollar just enough to help risk assets breathe. Bitcoin took the chance and its price run.

As the rally picked up speed, open interest rose, and funding rates flipped positive. None of this was subtle as we rushed to get back in after being too cautious for too long.

DISCOVER: 10+ Next Crypto to 100X In 2026

Ground Control to Major Tom, Take Your Protein Pills and Put Your Helmet On

Ethereum price matters. It is the first sign that we are going to see an altcoin season. ETH climbed steadily, supported by renewed inflows into spot ETFs after several quiet sessions. Institutional demand returned at the same time Bitcoin price broke higher, which helped validate the move when people were bearish.

On-chain data shows that the Ethereum price benefited from lower network fees following recent upgrades, and activity across DeFi picked up again. Exchange balances continued to drift lower as holders weren’t eager to sell into strength. These signals tend to lag headlines, but they help explain why crypto feels more stable on the way up this time.

"You can just build on the @ethereum L1."

– @VitalikButerin pic.twitter.com/d1ltwNsN4u

— Token Terminal

(@tokenterminal) January 12, 2026

Momentum Keeps Building

Regulation stayed in the background with relatively no effect on sentiment. The CLARITY Act may have been delayed, yet ongoing discussions and revised drafts kept expectations alive for clearer rules. This reduced uncertainty, which we need more than the delivery date right now.

After months of hard work, we have bipartisan text ready for Thursday’s markup. I urge my Democrat colleagues: don’t retreat from our progress. The Digital Asset Market Clarity Act will provide the clarity needed to keep innovation in the U.S. & protect consumers. Let’s do this! pic.twitter.com/fuu5CIQa8X

— Senator Cynthia Lummis (@SenLummis) January 13, 2026

Altcoins reacted quickly, outperforming Bitcoin price as traders rotated into higher-risk names. Volumes jumped, sentiment improved, and the market edged back. Bitcoin price is holding above $94,000 support, a good level for us, while Ethereum price strength continues to support the curious case of this cycle’s bull run.

Remember, bull market ends in euphoria, not depression.

DISCOVER:

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

JPMorgan Sounds Alarm on Yield Stablecoins and Bank Risk

2025 was defined by crypto stablecoins and the high yields. Yes, every investor desires to turn a higher return on his/her investment. Therefore, when the number of stablecoins tracking the greenback shot especially after the approval of the GENIUS Act back in July, it came as no surprise that bankers had some form of opposition.

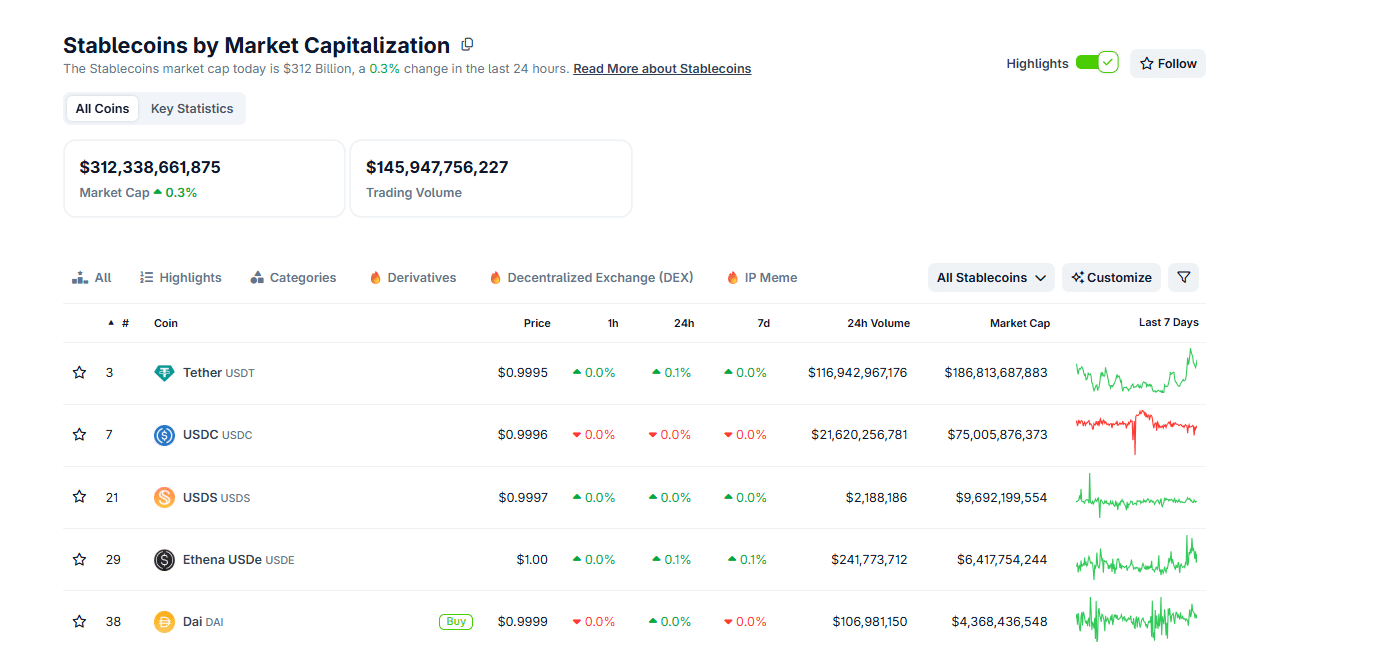

As of January 14, there are over $312Bn of various stablecoins in circulation. USDT by Tether dominates but there are even more from Circle, algorithmic options like USDS.

(Source: Coingecko)

With 2026 likely marked by even more stablecoins, not everyone is happy. During the Q4 2025 earnings call, JPMorgan CFO Jeremy Barnum warned investors that yield-paying stablecoins risk creating a shadow banking system outside long‑standing safeguards. These comments landed as the Bitcoin price traded near recent highs, with stablecoin supply still growing as new money enters crypto.

Read the full story here.

ZKsync’s 2026 Plan Targets Bank-Grade Privacy on Ethereum

Matter Labs CEO Alex Gluchowski shared the project’s roadmap for the year: What is the plan for ZKsync in 2026?

ZKsync is an Ethereum Layer-2 scaling solution developed by Matter Labs. It makes transactions on Ethereum faster and cheaper while keeping the same level of security. It uses zero-knowledge proofs, a technology that verifies transactions are correct without showing all the details publicly.

The plan moves away from early testing and focuses on building real infrastructure that banks, asset managers, and regulated institutions can use. It builds on tools launched in 2025, such as Prividium (a privacy-focused system), ZK Stack (a toolkit for custom chains), and Airbender (a fast proof generator).

The goal is to create systems that meet the needs of traditional finance, including strong privacy, full control, clear risk rules, and easy connections to global markets.

Gluchowski described Zksync 2026 as the year of moving from initial setups to large-scale use, with partnerships aimed at serving tens of millions of users.

Read the full story here.

The post Crypto Market News Today, January 14: Why Is Crypto Up? Bitcoin Blasts $95K, Ethereum With 7% Price Gain appeared first on 99Bitcoins.