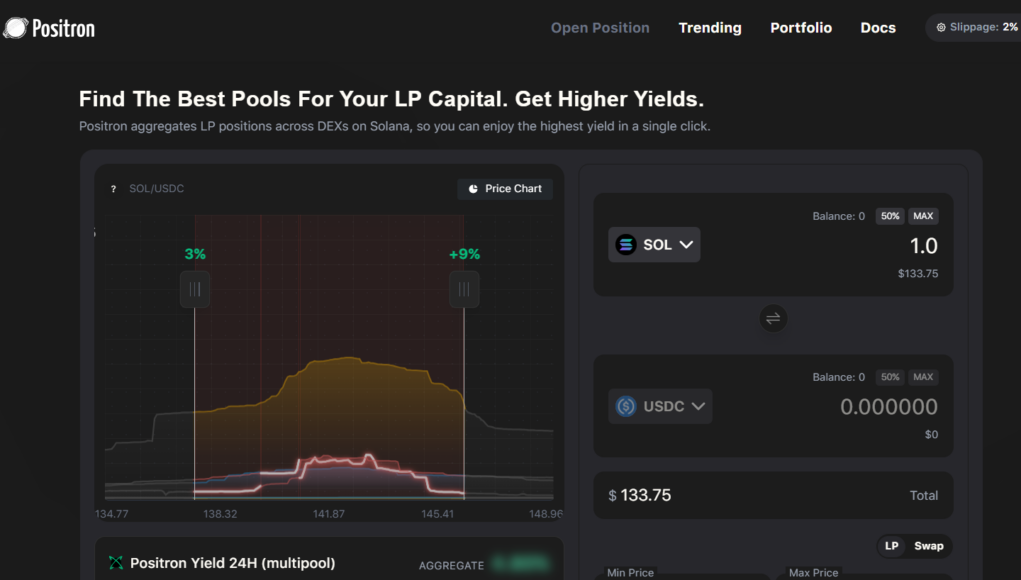

Positron is a non-custodial liquidity-routing protocol for Solana that deploys your capital across multiple pools in one click. It selects the highest-quality liquidity bands for your range and budget, turning fragmented LPing across venues into a streamlined, data-driven experience. In this article, we will explore the Positron Review.

What Is Positron?

Positron is a non-custodial liquidity-router for Solana that allows LPs to allocate liquidity across multiple pools with a single transaction. The protocol:

- selects optimal liquidity bands based on market conditions

- deploys capital across several pools

- maintains user custody of assets at all times

- charges zero swap fees and only a 1% creation fee

- supports Orca, Raydium, and Meteora, with more venues in the pipeline

When you create a position through Positron, the system opens multiple subpositions on underlying venues. Some of these may drift out of range over time—this is normal. What matters is that your aggregate Positron position remains optimized, leveraging system-wide liquidity instead of a single isolated pool.

Fragmentation: The Core Problem Positron Is Designed to Solve

Liquidity on Solana is highly fragmented. Each venue has different:

The result: no single pool is consistently optimal.

A visualization of overlapping SOL-USDC liquidity across the three major venues clearly shows this fragmentation—each pool peaks at different prices, creating blind spots for LPs who choose only one pool. Without aggregation, LPs are forced to:

- guess which pool might perform best

- monitor multiple dashboards

- frequently rebalance manually

- chase APRs that quickly become outdated

Positron abstracts all of this complexity, turning the fragmented market into a unified optimization layer.

Positron’s Multi-Position Model

Positron deploys liquidity across multiple individual positions (“bands”) on different DEXs. This model is powerful for several reasons:

1. Diversified Fee Exposure

Instead of relying on fixed fee generation in one venue, your capital collects fees from the most productive zones across the ecosystem.

2. Natural Risk Distribution

Even if one pool becomes inactive or liquidity-heavy (reducing your share), other pools continue producing yield.

3. Unified UX With Distributed Strategy

You see one Positron position, but behind the scenes the system manages dozens of subpositions for you.

This model mirrors how professional liquidity managers operate—split across many venues, tuned to market behavior, and rebalanced strategically.

How the Optimization Works: The Quality Function (Q)

Positron’s optimization engine identifies the best bands using a quality function (Q).

Q incorporates:

- current liquidity depth

- trading volume per venue

- fee generation potential

- historical performance

- impermanent loss characteristics

- user-defined price range

- total liquidity budget

- per-tick efficiency

Q essentially measures how much “work” each unit of liquidity will perform at a given tick and venue. Positron then selects bands that maximize total Q while respecting:

- minimum band widths

- execution cost limits

- slippage thresholds

- venue-specific rules

It is not just selecting high APR pools—it is building a mathematically optimized distribution of liquidity.

APR Calculation: A Transparent, Data-Driven Approach

Positron does not fabricate APR numbers. Instead, it computes APRs based on real fee data and realistic liquidity share estimates.

The APR computation pipeline includes:

- Splitting your capital across selected bands

- Converting each band allocation into the DEX’s actual liquidity structure

- Fetching 24h venue-specific fee data

- Analyzing tick density across the user’s selected range

- Distributing fee mass conservatively across ticks

- Estimating your liquidity share per tick

- Capping liquidity share to avoid unrealistic dominance

- Aggregating fee estimates into daily and annualized returns

The result is a grounded, defensible APR projection—not a marketing number.

Future APR Improvements

Positron plans to replace uniform fee distribution with a Brownian motion–based fee density model, meaning ticks closer to top-of-book will be weighted more accurately. This will significantly improve precision for volatile pairs and wide ranges.

Non-Custodial by Design

Positron never takes custody of user assets.

You approve every transaction, maintain your keys, and your liquidity lives directly within audited DEX contracts.

Positron generates transactions; it does not custody funds.

This design choice ensures:

- full user control

- transparency

- minimized platform risk

- compatibility with secure wallet setups

User Experience, Troubleshooting, and Support

To maintain reliable execution, Positron users should be aware of common issues:

- Jito tip too low → increase your tip to ensure bundle acceptance

- Slippage too low → volatile pairs may require higher slippage tolerance

- Balance too low → LPing requires rent for Solana accounts

For issues, users can reach out via:

- Twitter: @ademplabbers, @sitrongod

- Telegram: @ademplabbers, @sitrongod

- Email: [email protected]

The team is intentionally accessible—no bots, no token-driven hype, just real builders.

Supported Venues and Future Roadmap

Positron currently supports:

Upcoming plans include:

- expanding to additional pools and DEX architectures

- enabling optional user-triggered rebalancing (“crank button”)

- incorporating richer market signals into Q

- exploring adaptive fee modeling

These upgrades will further enhance Positron’s role as Solana’s liquidity optimization layer.

Positron Review: Conclusion

The Solana liquidity landscape has become too complex for manual, single-pool LPing to remain competitive. As liquidity fragments across venues and new AMM mechanics emerge, LPs need a system that can intelligently navigate this environment at scale.

Positron delivers that system.By unifying liquidity provisioning across multiple DEXs, optimizing band placement, and grounding its APR calculations in transparent data, Positron offers LPs higher efficiency, better risk distribution, stronger yield reliability, full self-custody and simple UX with sophisticated underlying strategy. If spot traders use aggregators for best execution, LPs deserve an aggregator for best yield.

Positron is that aggregator.

Does Positron have its own token?

Crucially, Positron does not have a token.

Everything is built for LP efficiency—not speculation, not emissions farming, and not governance theater.

Are there minimum liquidity requirements to use Positron?

Minimums vary based on the number of subpositions required and Solana rent costs for opening accounts. Very small deposits may fail if account creation costs exceed capital.

Does Positron support concentrated liquidity (CLMM) pools?

Yes. It actively chooses liquidity bands across CLMM venues like Orca, Raydium, and Meteora.