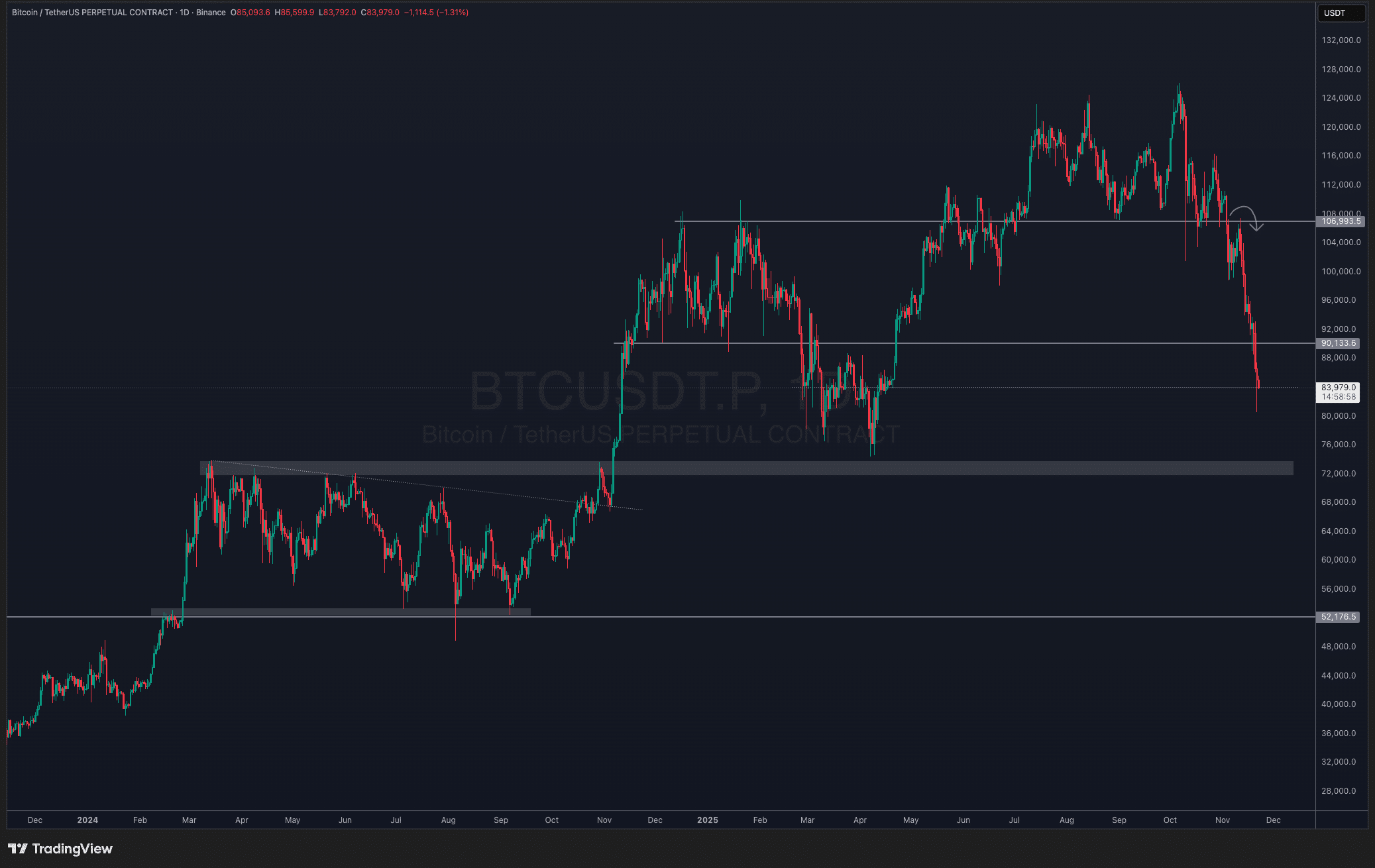

This week wrapped up in a way that most probably didn’t expect. BTC inflows finally flipped green again, and BTC USD pushed back toward the 85K area after wobbling for days.

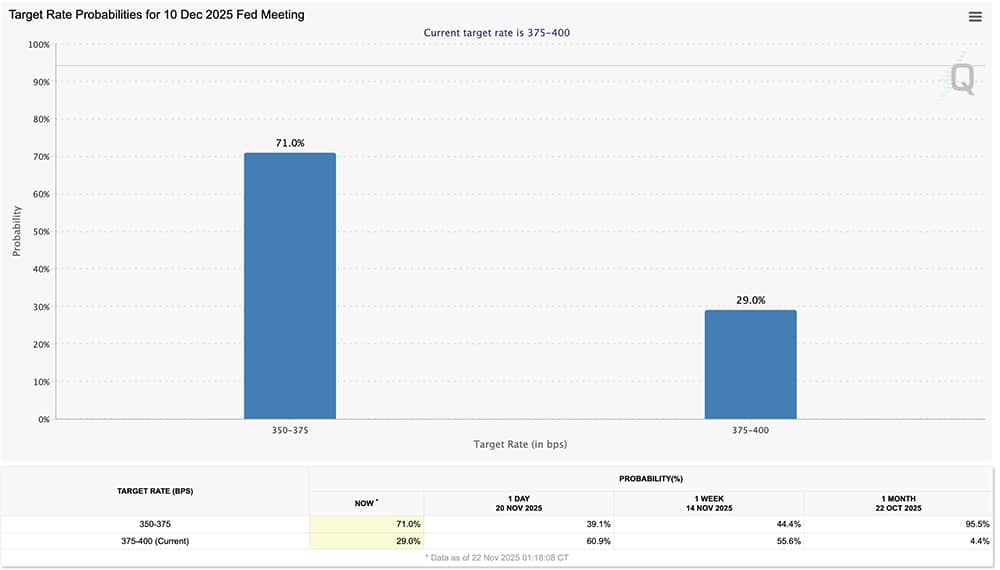

At the same time, rate cut babble exploded as the odds jumped above 70%, which is wild considering they were under 40% literally yesterday. Powell’s earlier dovish stance is finally settling in, and the mood shift across markets.

The combo of stronger BTC inflows, its strength versus USD, and growing rate cut confidence gave the market a small but noticeable lift.

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2025

BTC USD Price Action and Market Mood as Inflows Flip Green

For context, Bitcoin has dropped by over $26K in 10 days and is being hit harder day by day. A -24% move in such a short stretch is rattling anyone. What stood out, though, is that BTC USD didn’t fully break down as it held a few support zones that people didn’t expect to matter.

BTC dominance has slipped about 4% and is forming a death cross, which lines up with what we’ve been seeing from altcoins. Other BTC pairs snapped back from their October lows.

(source – BTC.D TradingView)

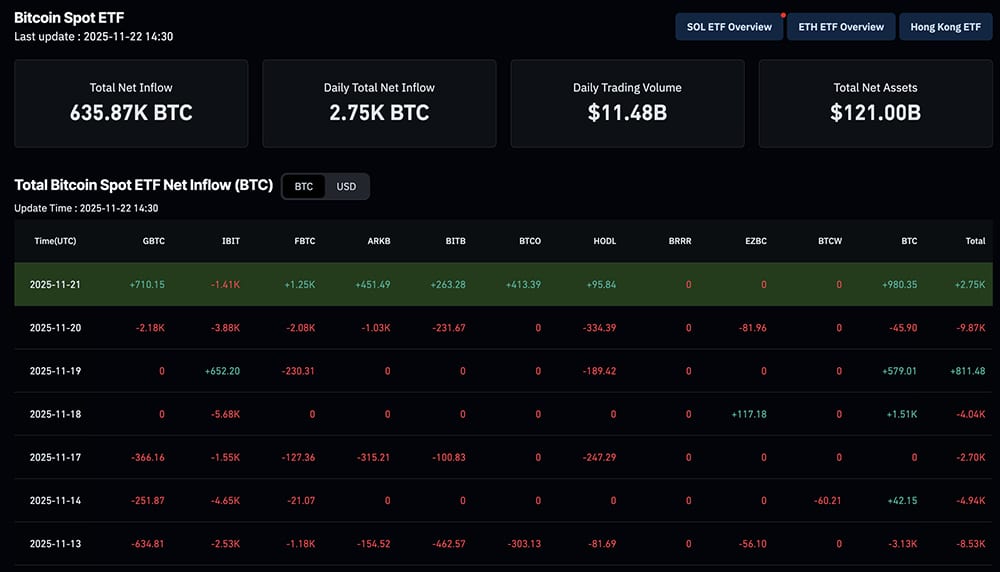

One of the few clean positives, BTC inflows are now turning green. ETF desks were finally reporting net inflows instead of the steady drip of outflows we’ve seen for days. Currently, BTC inflows are rising while altcoins hold their ground; this indicates that someone is buying the dip.

(source – Inflows Coinglass)

Another catalyst came from the jump in rate cut probability. Markets suddenly priced in over a 70% chance of a cut, which is a massive shift for a 24-hour window. Anytime a rate cut becomes more likely, people tend to rotate back into volatile assets, such as crypto.

(source – CME FedWatch)

All of the above, combined with the US Treasury’s $785 million debt buyback, which didn’t receive as much attention, matters. It tightens spreads and calms the bond market, which usually reduces the random shocks that spill over into crypto. That indirectly helps BTC USD and supports the improving tone behind BTC inflows.

BREAKING:

U.S Treasury just bought back $785,000,000 of its own debt. pic.twitter.com/sBtDJIPX8E

— Ash Crypto (@AshCrypto) November 22, 2025

All of these catalysts that don’t move the price instantly, but gradually shift the mood.

DISCOVER: 10+ Next Crypto to 100X In 2025

The Altcoin Market is Ready

Alts holding up while BTC drops is rare. A strong bounce in BTC USD could easily ignite them again, as Bitcoin’s RSI is sitting in classic oversold territory, the same place where reversals often start.

Ethereum and most alts had a quieter week compared to Bitcoin. While ETH followed BTC USD lower during the broader pullback, the pace of its decline was noticeably slower.

ETH’s RSI dipped toward the low 30s, a classic oversold territory. What makes it more intriguing is the drop in sales volume. The heavy red candles from earlier in the week didn’t actually continue as selling pressure keeps getting absorbed.

(source – ETH RSI, TradingView)

Another point that caught people’s attention was the ETH/BTC ratio. Even though BTC USD was getting hammered, ETH didn’t lose much ground against Bitcoin. It held its ratio band almost perfectly, which often signals an unobvious underlying strength.

(source – ETH BTC, TradingView)

Technically, ETH still needs to reclaim a couple of key moving averages that are hanging overhead, but the setup isn’t as bearish as the raw price might suggest. If BTC inflows continue improving and rate cut expectations stay elevated, ETH could easily be one of the first majors to bounce. And when it does, parabolic altseason will come.

For now, touch grass and enjoy the weekend.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Ex-LAPD Officer With Israeli Mafia Ties Stages Police Raid in $350K Crypto Heist

Prosecutors have revealed a sophisticated crypto heist involving a former LAPD officer and a man accused of having ties to Israeli organized crime, which led to a violent kidnapping attempt in Los Angeles late last year. On Friday, both suspects, ex-officer Eric Halem and alleged crime figure Gabby Ben, were denied bail after each pleaded not guilty to the charges.

Deputy District Attorney Jane Brownstone stated that the scheme had a single objective: to steal cryptocurrency from a teenager. Authorities allege that the 17-year-old victim ran a lucrative cryptocurrency operation from his LA apartment, where he stored a hard wallet containing approximately $350,000 in digital assets.

RED ALERT! EX-LAPD COP & ISRAELI MOB LINKED TO $300K CRYPTO HEIST & KIDNAPPING!

TRUE CRIME meets CRYPTO CHAOS

Eric Halem—former LAPD officer turned luxury car influencer—has been arrested and charged in a violent home invasion, crypto heist, and kidnapping tied to… pic.twitter.com/zMhryfP1Dh— RED NOTICE COIN (@RedNCoin) September 1, 2025

Read the full story here.

“Endure”: Michael Saylor Maintains Course as Bitcoin Trades Below $85,000 — He Still Calls It the Best Crypto to Buy

“Endure.” – Michael Saylor’s one-word post on X this week has come to represent Strategy’s position as Bitcoin, which Saylor continues to describe as the best crypto to buy for long-term value preservation, trades at $84,441 on November 22, 2025, down more than 4% in 24 hours and nearly 30% from its all-time high.

Endure. pic.twitter.com/ZgpX2DuFwH

— Michael Saylor (@saylor) November 21, 2025

The latest pullback follows several weeks of softer liquidity conditions, slowing ETF inflows, and mixed U.S. labor data, all of which have contributed to a risk-off shift across crypto.

The decline has renewed focus on whether a sustained move below $75,000 could create challenges for Strategy (NASDAQ: STRK, formerly MicroStrategy) and its $48.4 billion Bitcoin treasury.

(Source: Coingecko)

Read the full story here.

TAO Drops Below Support, Pi Crypto Holding Unexpectedly: Choosing The Best Crypto To Buy Now

Pi and TAO crypto are refusing to move in the same direction. TAO slipped under a couple of big support levels, while Pi crypto somehow managed to push nearly 10% higher this week.

Both Pi and TAO sit inside the same bearish crypto market mood, even with Bitcoin outflows going green after that nasty overnight dump. Yet these two couldn’t be behaving more differently.

It is a moment where sentiment and fundamentals decide to go their separate ways.

Pi Network already Bullish on daily Chart God bless @PiCoreTeam @Dr_Picoin pic.twitter.com/DhhwmCG4Zc

— Joseph Daniel (@arnelmb777) November 20, 2025

Read the full story here.

The post Crypto Market News Today, November 22: BTC Inflows Turn Green as BTC USD Pushes Toward 85K With Fed Rate Cut Odds Shooting Past 70% appeared first on 99Bitcoins.