In a market where narratives shift daily and data drives every decision, SoSoValue is carving a name for itself as a must-have platform for serious crypto researchers. Instead of offering a place to trade, it focuses on empowering investors with the tools to understand the “why” behind price movements. This AI-powered platform blends on-chain analytics, macro-economic insights, and real-time market data into a single research interface. Whether you’re analysing Bitcoin dominance, tracking DeFi liquidity, or studying yield trends, SoSoValue aims to help you separate hype from hard data. This review explores its most impactful features — from project analysis to macro indicators and the innovative SoDEX — to show how SoSoValue is helping traders and analysts make more intelligent, informed decisions in 2025.

What Is SoSoValue?

SoSoValue describes itself as a “one-stop financial research platform for crypto investors.” Rather than a typical trading venue, it’s a research powerhouse designed to organise, analyse, and visualise everything from token fundamentals to macroeconomic liquidity. It aggregates price data, market indicators, funding rounds, and sector performance metrics, giving users a structured way to study the crypto economy as a whole. By bridging crypto and traditional finance, SoSoValue helps investors connect market behaviour with broader global trends such as inflation, interest rates, and institutional flows.

Accessible through web or wallet login, SoSoValue also enables personalisation through dashboards and watchlists — making it equally useful for casual investors and professional analysts.

Core Features of SoSoValue

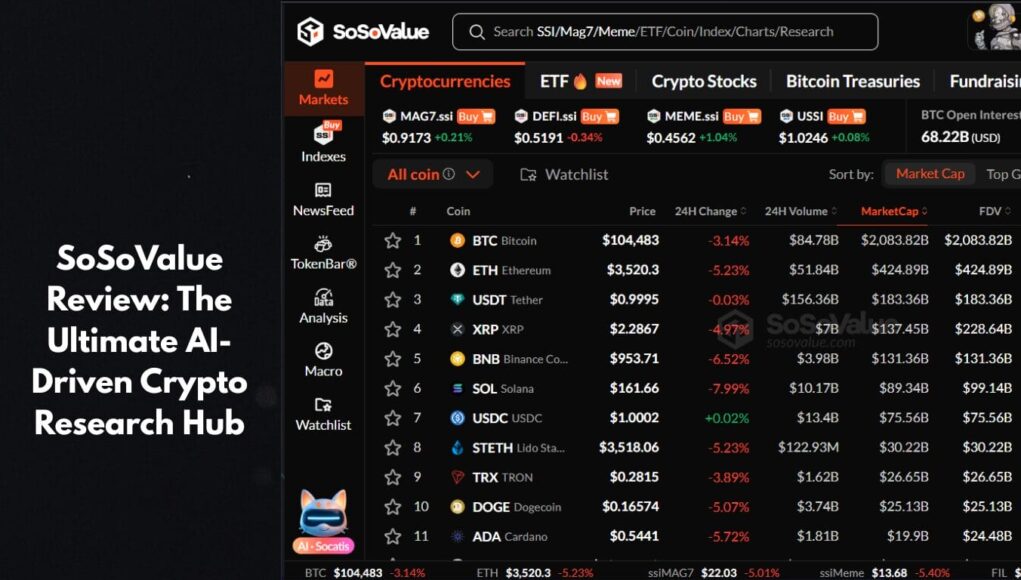

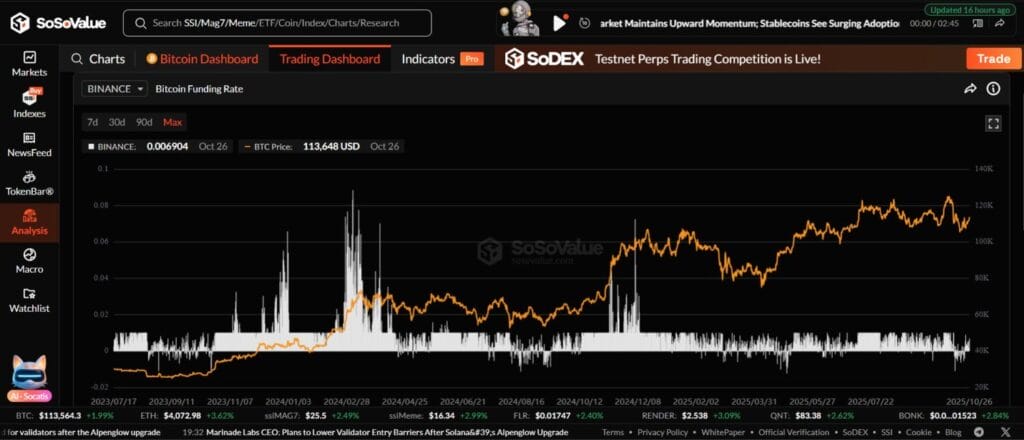

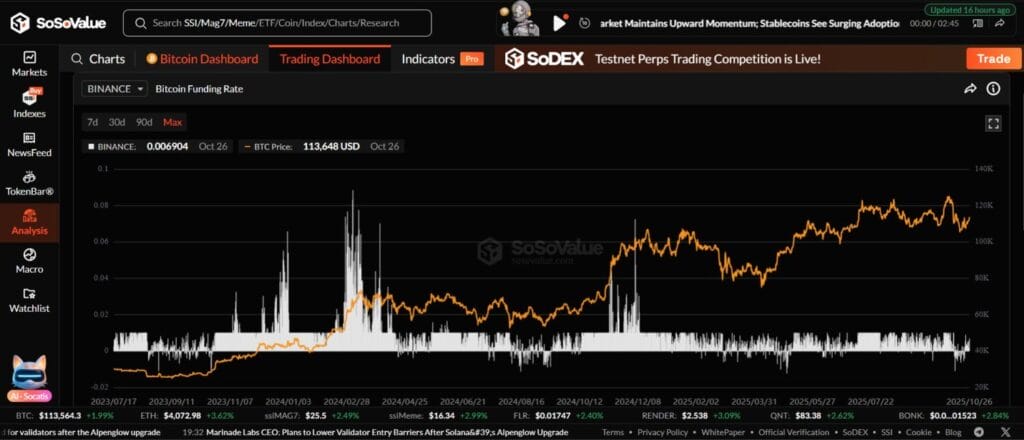

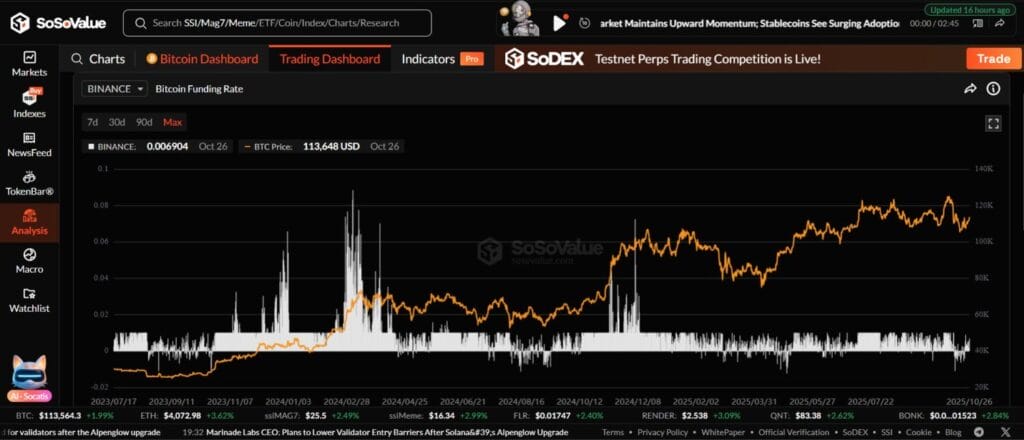

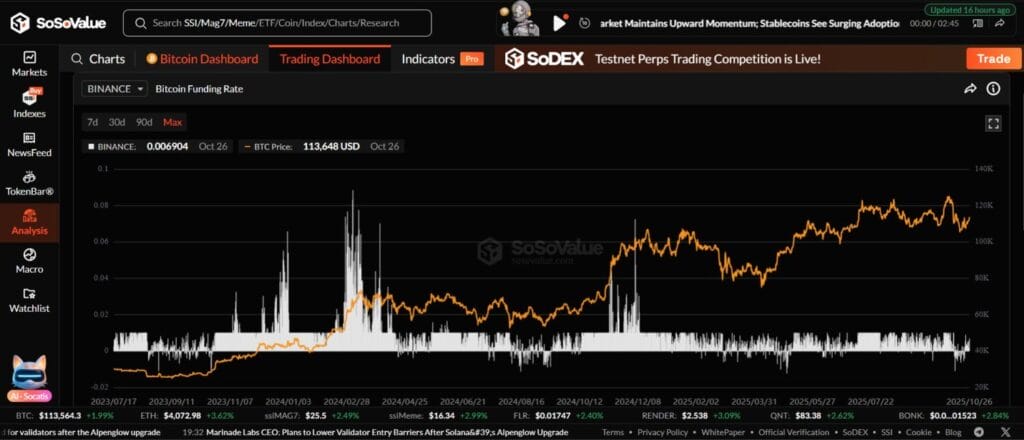

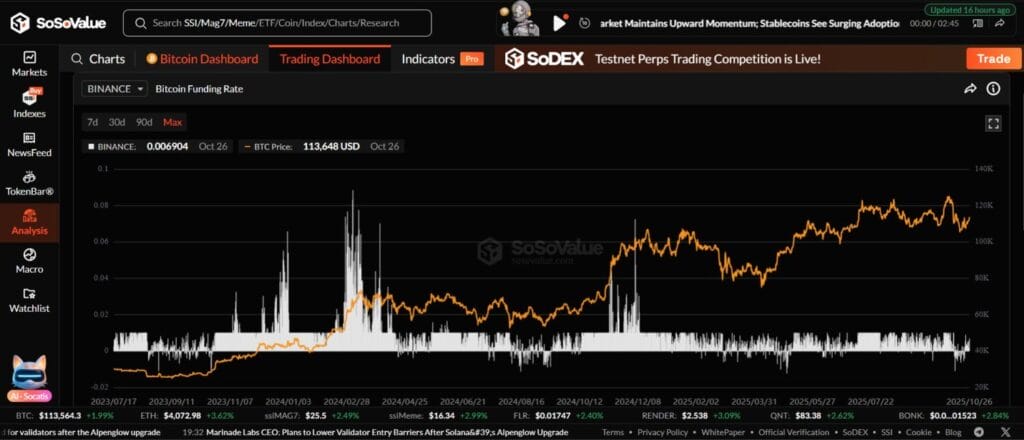

Market Dashboard

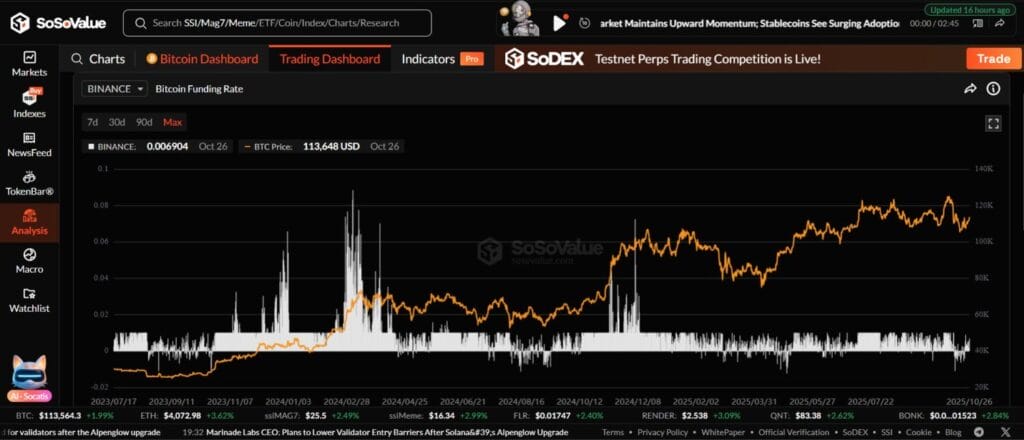

The Market Dashboard serves as SoSoValue’s home base, offering real-time snapshots of the global cryptocurrency market. It displays total market capitalisation, 24-hour trading volumes, and price movements across top-performing tokens. The interface is clean yet data-rich, letting users grasp the market’s direction at a glance. For traders, it functions as a pulse check on sentiment and liquidity — an instant gauge of whether capital is flowing in or out of the ecosystem.

Project Pages

Each cryptocurrency listed on SoSoValue has a dedicated project page that aggregates deep analytical data. These pages feature real-time price charts, fundamental stats, tokenomics, unlock schedules, investor and funding information, and curated research articles. Instead of hunting for scattered data across multiple sites, users can perform comprehensive due diligence within one centralised hub. For new tokens, SoSoValue’s structure makes it easy to understand not only price performance but also the fundamentals driving it.

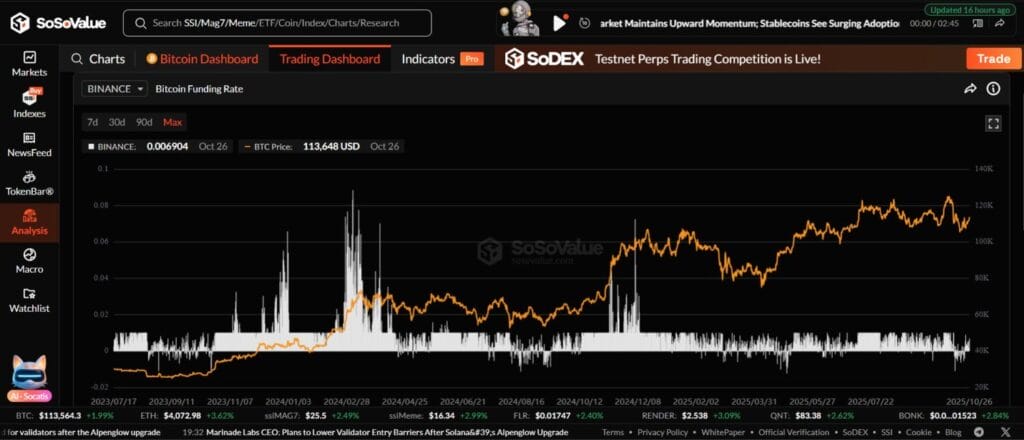

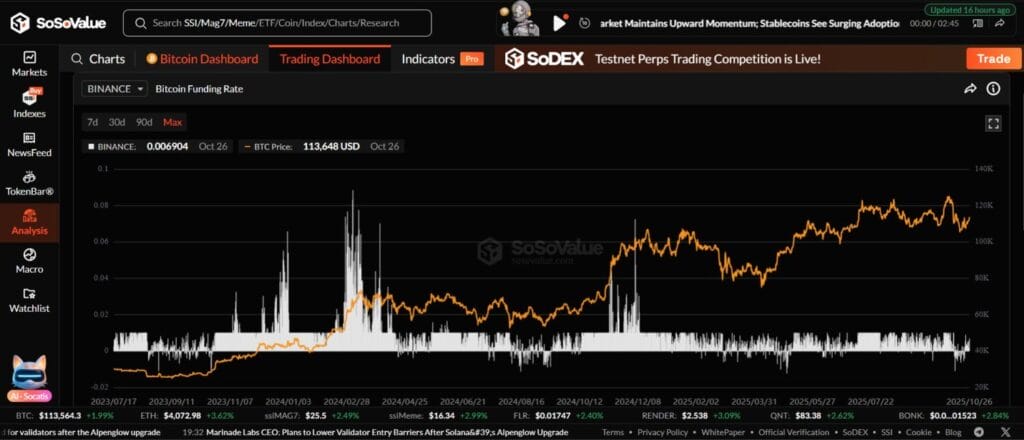

Dashboards and Layer Analytics

SoSoValue’s Dashboard Suite provides visualised analytics for both Layer 1 and Layer 2 ecosystems. The “General View” dashboard summarises overall market metrics like transaction activity, TVL, and sector performance. Meanwhile, the “Layer 2 Dashboard” zeroes in on scaling networks, giving insight into adoption trends, throughput, and ecosystem growth. This separation allows analysts to observe how new scalability technologies are performing relative to base chains such as Ethereum or Solana.

SoSo Watchlist 100

The SoSo Watchlist 100 is a quarterly-updated index that highlights the top 100 crypto assets by market capitalisation, excluding stablecoins and derivatives. This curated list serves as a benchmark for investors tracking blue-chip tokens or comparing performance against the broader market. For portfolio managers and analysts, it’s a reliable reference point that simplifies macro-level market tracking and trend detection.

Portfolio Tracker

The Portfolio Tracker lets users personalise their research experience by building watchlists and tracking their favourite tokens in real time. Each portfolio can be customized with metrics such as daily change, market cap, and price correlation. For traders managing multiple assets, it functions like a lightweight analytical portfolio dashboard — ideal for monitoring positions and identifying divergence between sectors or strategies.

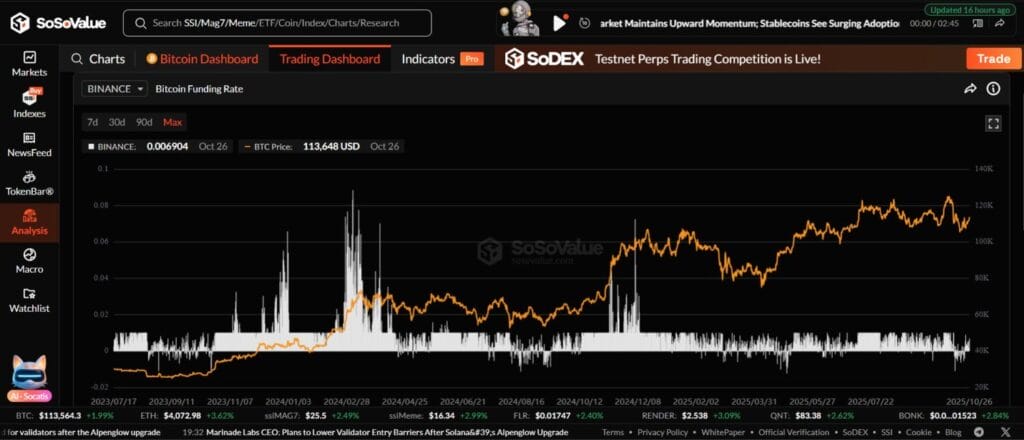

Macro Finance Tools

What sets SoSoValue apart from other analytics platforms is its integration of macroeconomic data. The Macro Finance section includes an analysis app for the economic calendar, interest-rate tracker, and liquidity indicators, helping investors understand how traditional financial dynamics affect crypto valuations. This feature bridges decentralised finance and global economics, showing correlations between risk appetite, central-bank policy, and digital-asset momentum.

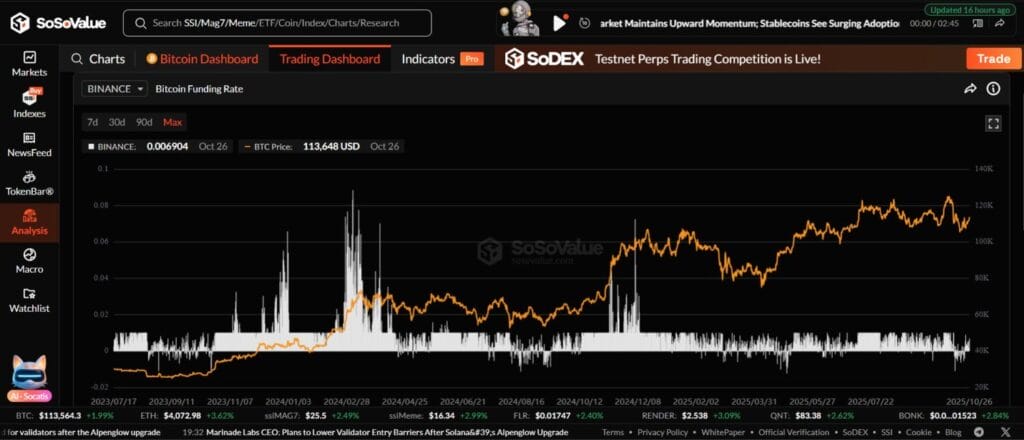

Indexes Comparison

For quantitative researchers, SoSoValue offers an Indexes Comparison Tool that enables side-by-side analysis of multiple datasets. Users can compare up to with the help of market indicators — spanning on-chain, technical, social, and macro variables — and export data to Excel for deeper study. This function allows for advanced correlation testing, such as analysing how Ethereum gas prices move relative to stablecoin supply or comparing DeFi TVL against global bond yields.

SoDEX: Integrated Decentralised Exchange

Although primarily a research platform, SoSoValue also provides a trading avenue through SoDEX, its in-house decentralised exchange built on ValueChain L1. SoDEX combines institutional-grade performance with full transparency, using an order-book model to support fast and secure on-chain trading. It allows analysts to transition seamlessly from research to execution without leaving the SoSoValue ecosystem.

Hot Concepts and Sector Intelligence

SoSoValue brings context to its data through the Hot Concepts and Sector Analysis sections. The platform highlights emerging narratives like Binance Launchpool, Solana Wallet, LSDFi, Real-World Assets (RWA), AI tokens, and GameFi projects. Each concept page explores the project’s purpose, market traction, and long-term potential, giving users early visibility into high-growth themes.

To structure this further, SoSoValue divides the crypto market into 16 key sectors — including BTC, ETH, DeFi, Layer 1, Layer 2, CEX, Stablecoins, AI, GameFi, SocialFi, NFT, DePIN, RWA, and Infrastructure. By tracking each sector’s market-cap share and daily flow, the platform helps investors identify capital rotations and understand where institutional interest is moving next.

Educational Resources and News

SoSoValue doesn’t stop at analytics; it also functions as an educational resource. The Crypto 101 section introduces newcomers to blockchain concepts, while the Blog offers in-depth coverage of topics like staking, DeFi, macro policy, and Layer 2 scaling. Meanwhile, the NewsFeed and Analysis tabs curate breaking crypto and macroeconomic updates in real time. This combination of learning and live insight transforms SoSoValue from a data tool into a full-spectrum research companion.

Pros and Cons of SoSoValue

Pros

- Comprehensive Data Ecosystem

SoSoValue delivers an all-in-one research environment that combines crypto market analytics, project fundamentals, and macroeconomic data. This holistic approach makes it a genuine alternative to institutional-grade data terminals, providing a comprehensive view of both on-chain and off-chain trends. - AI-Enhanced Market Intelligence

The platform’s AI engine curates trending assets and emerging narratives, helping users quickly identify where capital and attention are flowing. This automation adds clarity to the noise-heavy crypto landscape, especially during volatile cycles. - Deep Project Research and Transparency

Each token’s profile includes detailed insights such as tokenomics, unlock schedules, funding history, and investor data. This level of transparency empowers traders and analysts to make informed, evidence-backed decisions rather than relying on speculation. - Macro-Financial Integration

By integrating liquidity flows, interest-rate trackers, and economic calendars, SoSoValue bridges the gap between traditional finance and decentralised markets. This macro lens gives investors the ability to interpret crypto performance in a broader economic context — a feature few competitors offer. - Seamless Experience with SoDEX

The addition of SoDEX, SoSoValue’s decentralised exchange built on ValueChain L1, creates a smooth bridge between research and execution. Traders can analyse data and act on insights without switching platforms, streamlining their workflow.

Cons

- No Fiat Gateway

SoSoValue does not support direct crypto purchases or fiat deposits. Users must rely on external exchanges for onboarding funds or executing large trades. - Limited Trading Functionality

Although SoDEX adds value, it lacks the depth and liquidity of leading decentralised exchanges. The platform remains primarily a research and analytics tool rather than a full trading terminal. - Account Requirement for Key Features

Advanced tools like portfolio tracking, dashboard customisation, and data export are gated behind a login. This may be a minor inconvenience for users seeking instant access. - Lack of Transparent Pricing

SoSoValue has yet to fully disclose its fee structure for SoDEX transactions or potential premium data services. Publicly available pricing details would enhance user confidence. - Data Overload for Beginners

The platform’s depth and density can overwhelm newcomers. Without prior experience in analytics or market research, some users might find the interface complex at first glance.

Who Should Use SoSoValue?

SoSoValue is ideal for traders and analysts who prioritise research over speculation. Institutional investors can utilise its dashboards and macro modules for market modelling, while retail users benefit from its easy-to-read project pages and curated watchlists. For macro-crypto strategists, the integration of economic indicators and liquidity data provides a decisive analytical edge.

Conclusion

SoSoValue has positioned itself as one of the most comprehensive AI-driven research platforms in the crypto industry. By merging token data, macro context, and on-chain intelligence, it turns raw information into meaningful insights. From project fundamentals to SoDEX execution, every component reflects a focus on analytical precision and transparency.

While it doesn’t yet rival exchanges in trading capability, its data depth, dashboard accuracy, and sector clarity make it indispensable for anyone serious about crypto research. Whether you’re managing portfolios, building models, or simply seeking credible insights, SoSoValue is the kind of platform that brings structure, reliability, and foresight to the chaos of crypto markets.

Frequently Asked Questions (FAQs)

What is SoSoValue, and what makes it unique?

SoSoValue is an AI-powered crypto research platform that consolidates market data, macroeconomic indicators, and on-chain analytics in one place. Unlike traditional analytics dashboards, it connects crypto market trends with global financial movements, offering a holistic view of market behavior and investor sentiment.

Does SoSoValue support trading or portfolio management?

Yes, but indirectly. SoSoValue primarily serves as a research and analytics tool, not a full exchange. However, it integrates SoDEX, a decentralised exchange built on ValueChain L1, allowing users to act on insights without leaving the platform. For broader portfolio management, it includes personalised watchlists and portfolio tracking features.

Is SoSoValue free to use?

Most of SoSoValue’s core research and analytics tools are free, including project pages, dashboards, and sector data. Some advanced features — such as data export, portfolio syncing, or professional analytics — may require login access or a future premium plan.

Who can benefit most from SoSoValue?

SoSoValue caters to a broad range of users — from individual crypto traders and analysts to institutional investors and DeFi researchers. Its AI-driven curation, macro dashboards, and deep token research make it especially valuable for those who base decisions on data rather than hype.

How does SoSoValue compare to other platforms like DefiLlama or Token Terminal?

While DefiLlama focuses on DeFi metrics and Token Terminal emphasizes financial modeling, SoSoValue bridges both worlds — offering a mix of on-chain, macro, and market data in one integrated hub. It also provides unique tools like SoDEX, indexes comparison, and the SoSo Watchlist 100, making it more comprehensive for yield and narrative tracking.