Crypto prediction markets let you trade “shares” in future outcomes; prices act like real-time probabilities as news changes. On-chain smart contracts handle custody and payouts via your wallet, offering transparency and global access. You’ll still manage gas, fees, market rules, and local compliance. If you’re new, start small, read resolution criteria closely, and learn how prices map to implied odds before scaling up. In this article you will explore the 5 Best Crypto Prediction Markets.

- A crypto prediction markets are blockchain-based venue where people trade shares tied to future events, and the changing price of each share reflects the crowd’s evolving estimate of that event’s probability.

- Instead of betting against a bookmaker, participants trade with each other or a liquidity pool, allowing prices to move continuously as new information arrives and beliefs change throughout the life of the market.

- Each market is encoded in smart contracts that automatically track positions, hold collateral, and trigger payouts when an official outcome is recorded, reducing reliance on centralized intermediaries for custody and settlement.

- Markets can cover elections, sports, cryptocurrency prices, technological milestones, entertainment outcomes, macroeconomic releases, and even community governance decisions, enabling people to express and monetize their information or convictions across many domains.

- The price of a “YES” share often maps directly to implied probability, so a price near 0.70 suggests roughly seventy percent odds before fees, which makes market screens intuitive for newcomers learning to interpret likelihoods.

- Resolution depends on an oracle or pre-defined data source that confirms what happened in the real world, and many platforms include dispute processes or arbitration rules to protect traders from ambiguous wording or bad data.

- Because these platforms use wallets and tokens, users typically need to fund supported assets, understand transaction fees, and verify regional access rules, but in return they gain transparency, fast settlement, and global market access.

What to consider before choosing a prediction market

- Start by confirming regional access, identification requirements, and tax obligations, because availability and compliance vary by jurisdiction, and understanding the rules upfront prevents account interruptions and unpleasant surprises after profitable trades.

- Evaluate custody and decentralization, asking whether funds stay in your wallet and how settlement occurs, since on-chain transparency and audited contracts can reduce counterparty risk compared to opaque off-chain arrangements.

- Compare liquidity and depth on the topics you actually care about, because tight spreads and robust volume reduce slippage, enable quicker exits, and make it easier to manage risk as information changes.

- Review fees, gas costs, and collateral types to understand your breakeven probability, recognizing that even small frictions compound over time and meaningfully influence the profitability of frequent trading strategies.

- Read market rules and resolution criteria line by line, including data sources, time zones, and tie-breakers, since careful interpretation prevents unexpected outcomes when ambiguous wording collides with messy real-world events.

- Consider user experience and ecosystem fit, choosing platforms aligned with your existing wallets, preferred networks, and comfort level, because familiar tooling reduces onboarding friction and helps you focus on research, sizing, and execution.

- Start small, track results, and iterate on a written plan, since disciplined position sizing, journaled reasoning, and post-mortems will compound your learning and reduce emotional decision-making in fast-moving or polarizing markets.

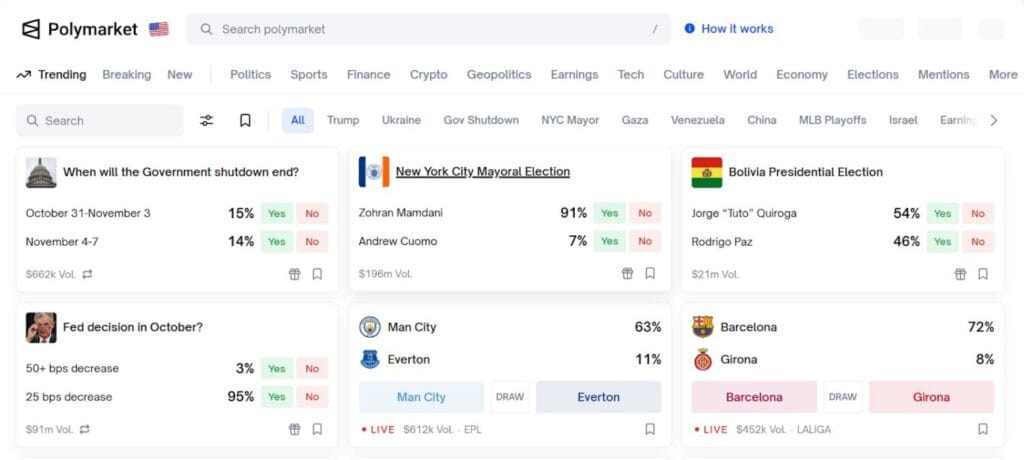

1) Polymarket

- Polymarket offers a wide catalog of real-world event markets with straightforward YES and NO shares, letting beginners interpret prices as probabilities and enter or exit positions quickly as news breaks and narratives evolve.

- Trading is non-custodial at the contract level, while the interface focuses on clarity and speed, helping first-time users understand market pages, order tickets, settlement conditions, and the overall risk of each position before committing funds.

- Liquidity is typically strong on popular topics, which improves fill quality and reduces slippage, so users can scale positions or unwind quickly when volatility spikes or when their view changes after new information becomes available.

- Funding commonly uses stablecoins, which keeps accounting simple by minimizing exposure to crypto price swings, though users should still understand gas costs, platform fees, and potential spreads that affect net returns and breakeven probabilities.

- Market rules and resolutions are clearly described on each page, and learning to read those rules carefully helps traders avoid misunderstandings around timing, acceptable data sources, and any edge cases that might affect outcome determination.

- Polymarket’s social discovery features, leaderboards, and trending lists help newcomers find active markets, but thoughtful research beyond the interface remains essential for forming independent forecasts and avoiding herd behavior during buzzy headlines.

- Overall, Polymarket suits beginners seeking a polished experience, intuitive probabilities, and deep activity on mainstream topics, while still rewarding disciplined users who analyze wording, timing, and risk management before placing significant trades.

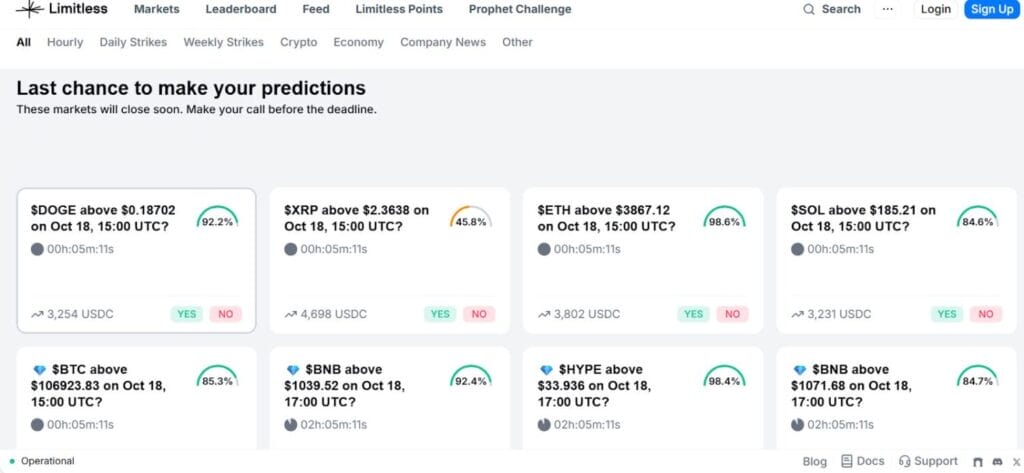

2) Limitless (Base; high-frequency financial prediction market)

- Limitless is a decentralized prediction market built on Coinbase’s Base chain, focused on nonstop hourly and daily markets that let you forecast short-term moves in crypto and stock prices with on-chain settlement.

- The app uses a central limit order book (CLOB) interface with market and limit orders, aiming for speed and low fees on Base rather than AMM curves like LMSR, which many DeFi markets use.

- Many markets resolve via trusted price feeds (e.g., Pyth), so outcomes are tied to precise timestamps and data sources, minimizing ambiguity typical of subjective, news-driven questions. Always check the market’s stated oracle.

- Its niche is high-frequency, short-duration contracts—minutes, hourly, or daily—designed for active traders who want to express quick views on volatility rather than long, thematic plays on elections or sports.

- Reported activity and third-party trackers describe rapid growth on Base, with nine-figure cumulative volumes and a positioning as the network’s leading prediction venue; verify current stats on the project dashboard before trading.

- Market creation emphasizes natural-language expressions and financial underlyings, but you should still read rules carefully—especially cutoff times, reference exchanges, and settlement windows—to avoid surprises near resolution.

- Best for Solana- or Ethereum-native users exploring Base who want fast fills, granular timeframes, and tight tracking to oracle prices; start small, use limits, and factor fees into your breakeven probabilities.

3) Zeitgeist (Polkadot-native prediction chain)

- Zeitgeist operates as a Polkadot-native chain built specifically for prediction markets, giving developers and users dedicated infrastructure designed for performance, customizability, and interoperability within the broader Substrate ecosystem.

- The protocol exposes an SDK that lets teams embed markets into applications or organizational processes, making it easier to launch tailored experiences, dashboards, or governance models powered by collective forecasting.

- Zeitgeist emphasizes always-available liquidity models that keep markets tradable throughout their lifecycle, though users should still consider pool depth, volatility, and transaction timing when sizing positions or planning exits.

- Futarchy features allow organizations to experiment with policies guided by market signals, where defined outcomes and incentives steer decisions, aligning governance with measurable goals instead of purely subjective deliberation.

- Traders can access markets beyond binary questions, including multi-outcome or numeric structures, which unlock richer forecast expression while also requiring users to understand payout logic and probability normalization among competing possibilities.

- Because it is a purpose-built chain, a Zeitgeist wallet and cross-ecosystem bridges may be part of onboarding, so new users should follow official guides to manage assets and understand fee mechanics before trading.

- Zeitgeist suits builders, DAO participants, and researchers who want customizable markets, interoperable tools, and governance experiments, while still welcoming individual traders who prefer a chain optimized for forecasting use cases.

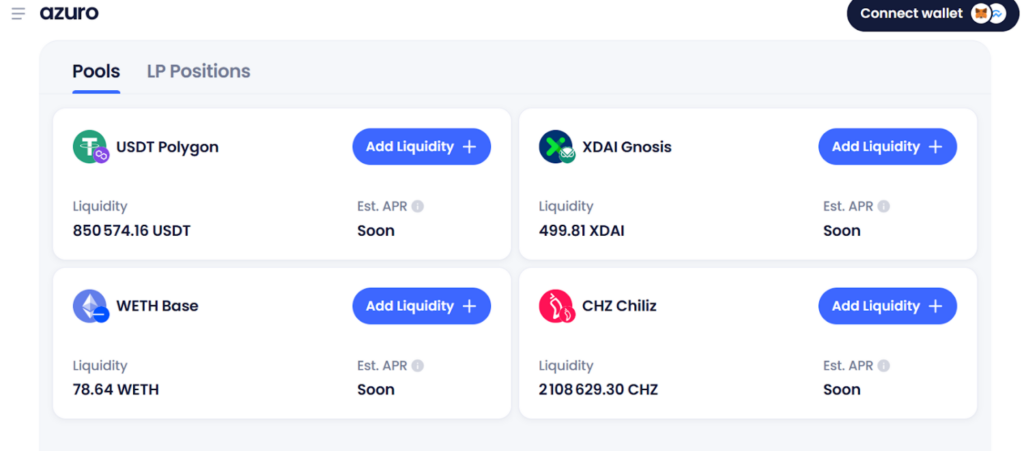

4) Azuro Protocol (EVM prediction-infra, peer-to-pool)

- Azuro is open infrastructure that powers many frontends, using peer-to-pool mechanics where users trade against liquidity pools rather than matching directly with other individuals on a traditional order book.

- This design automates pricing and payouts through smart contracts, allowing applications to list numerous sports and real-world markets without custodial risk or manual odds making, while still enabling liquidity providers to earn fees for underwriting activity.

- Because it is EVM-based, Azuro can deploy across multiple chains, so users can choose networks that match their cost preferences and existing wallets, reducing friction for those already active in common Ethereum-compatible ecosystems.

- Frontends built on Azuro can differentiate with specific sports, user experiences, rewards, and responsible-gaming features, so evaluating each interface’s clarity, market coverage, and customer support remains important before committing funds.

- Prices update continuously as trades interact with pools, which means liquidity depth and risk parameters influence slippage and implied probability changes, especially around kickoff times, injuries, lineup news, or unexpected real-world developments.

- Collateral types and fee structures vary by deployment, so users should check accepted tokens, settlement timelines, and any withdrawal constraints to understand net returns and practical cash-flow considerations over a trading week or season.

- Azuro is best for sports-focused users and builders who want decentralized plumbing with flexible frontends, combining predictable on-chain settlement with the convenience of familiar event categories and streamlined user flows.

5) Drift BET (Solana prediction module)

- Drift BET brings crypto prediction markets to Solana’s high-throughput environment, offering fast confirmation times and low transaction costs that help active traders manage entries and exits efficiently during rapid information flow.

- The module integrates with Drift’s broader application, enabling users to post supported tokens as collateral and potentially manage multiple strategies under one interface, which streamlines portfolio oversight and reduces platform switching.

- Trading focuses on clear binary outcomes with intuitive settlement, yet users should still review market rules, oracle sources, and cutoff times to avoid misunderstandings that can arise near deadlines or during volatile news events.

- Solana’s performance characteristics reduce congestion risk during peak periods, but prudent sizing and limit orders remain essential risk controls, especially when markets gap on surprise announcements or breaking developments.

- Because Drift has a wider ecosystem of perpetuals and yield features, prediction traders can sit alongside other DeFi activities, though keeping strategies separated conceptually helps maintain discipline and prevents unintended risk overlap.

- Fees and funding mechanics are transparent within the app, so reviewing cost breakdowns and historical fills can improve execution, inform breakevens, and guide decisions about which markets justify active trading versus passive observation.

- Drift BET suits Solana-native users who value speed, integrated tooling, and straightforward binary markets, while still emphasizing careful reading of rules and measured position sizing for consistent long-term performance.

Conclusion

Crypto prediction markets make forecasting hands-on: instead of passively consuming polls or punditry, you test your view against the crowd—and the price tells you how confident the market is at any moment. The best crypto prediction markets for you depends on three things: where you’re allowed to trade, which blockchain ecosystem you already use, and what kinds of markets you actually care about. Prioritize clear rules, decent liquidity, and straightforward funding. Keep a written plan, size modestly, and review outcomes to improve your edge. Above all, remember that probability is not certainty: even 80% favorites lose one time in five, so treat risk management as seriously as your research.

Is this legal where I live?

Availability varies widely by country and sometimes by state or province. Many platforms restrict certain regions or require KYC. Always check the platform’s access policy and your local laws before depositing any funds.

Do I owe taxes on profits?

Can I lose more than I deposit?

On simple YES/NO share markets without leverage, your maximum loss is typically the amount paid for your shares (plus fees). Leveraged products or borrowed funds can change that—avoid leverage until you fully understand the risks.