With crypto staking gaining mainstream traction, asset managers are exploring ways to package staking rewards into regulated investment products like exchange-traded funds (ETFs). But not all blockchains are suited for the job.

Bitwise CEO, Hunter Horsley, appearing at the Singapore Token2049 event, agreed with that sentiment and opined that Solana

.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}

2.02%

Solana

SOL

Price

$225.15

2.02% /24h

Volume in 24h

$7.84B

<!–

?

–>

Price 7d

// Make SVG responsive

jQuery(document).ready(function($) {

var svg = $(‘.cwp-graph-container svg’).last();

if (svg.length) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘height’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘height’);

svg.css({‘width’: ‘100%’, ‘height’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

could have an edge over ETH

.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}

1.46%

Ethereum

ETH

Price

$4,401.18

1.46% /24h

Volume in 24h

$31.75B

<!–

?

–>

Price 7d

// Make SVG responsive

jQuery(document).ready(function($) {

var svg = $(‘.cwp-graph-container svg’).last();

if (svg.length) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘height’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘height’);

svg.css({‘width’: ‘100%’, ‘height’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

crypto staking.

The key difference lies in how quickly staked assets can be withdrawn.

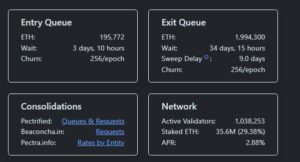

ETH staking struggles with slow withdrawals when the network gets busy. In early September, over 860,000 ETH were waiting to be staked, the highest in over a year. That number has dropped to around 202,000 ETH with a three-day wait, but getting your staked ETH back still takes much longer.

(Source: Validator Queue)

Solana, on the other hand, offers faster unstaking, allowing users to return investor funds more quickly. This is a critical requirement for ETF providers who have to meet redemption timelines.

Bitwise CEO Hunter Horsley highlights Solana's advantage over Ethereum in the staking ETF race, thanks to its shorter unstaking period. User sentiment has shown fluctuating preferences between the two, with Solana gaining traction recently, indicating its potential appeal as a…

— Gaal (@Gaal_ai) October 2, 2025

Staking means locking up crypto to support the network and earn rewards. But once locked, it’s harder to access quickly. That’s a problem for ETFs and other investment products that need fast access to funds.

“It’s a huge problem,” Horsley said. “ETFs need to be able to return assets on a very short time frame. So this is a huge challenge,” he added.

Solana’s design, with shorter unstaking periods and smoother withdrawal mechanics as a result, could give it a practical edge as staking ETFs evolve.

(Source: Solana Validators)

However, as with everything, there are workarounds available. Horsley mentioned Bitwise’s ETH staking product in Europe, which uses a credit facility to keep investor redemption liquid. This option, however, does not come cheap and also has limited scalability.

He also mentioned using liquid staking tokens like Lido’s ETH. These tokens represent staked Ethereum and let investors stay liquid while still earning rewards.

EXPLORE: Top 20 Crypto to Buy in 2025

What Does The Prediction Market Think?

Well, the predictions market has spoken on this matter, and the verdict is somewhat complicated. With ETH gaining momentum, users on the Myriad market are giving it a 62% chance of hitting $5,000 before falling to $3,500.

(Source: Myriad Markets)

That’s a sharp rise from just 32% last week. From where

.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}

1.46%

Ethereum

ETH

Price

$4,401.18

1.46% /24h

Volume in 24h

$31.75B

<!–

?

–>

Price 7d

// Make SVG responsive

jQuery(document).ready(function($) {

var svg = $(‘.cwp-graph-container svg’).last();

if (svg.length) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘height’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘height’);

svg.css({‘width’: ‘100%’, ‘height’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

is trading right now, it needs less than a 15% push to reach its new ATH.

.cwp-coin-chart svg path {

stroke-width: 0.65 !important;

}

2.02%

Solana

SOL

Price

$225.15

2.02% /24h

Volume in 24h

$7.84B

<!–

?

–>

Price 7d

// Make SVG responsive

jQuery(document).ready(function($) {

var svg = $(‘.cwp-graph-container svg’).last();

if (svg.length) {

var originalWidth = svg.attr(‘width’) || ‘160’;

var originalHeight = svg.attr(‘height’) || ’40’;

if (!svg.attr(‘viewBox’)) {

svg.attr(‘viewBox’, ‘0 0 ‘ + originalWidth + ‘ ‘ + originalHeight);

}

svg.removeAttr(‘width’).removeAttr(‘height’);

svg.css({‘width’: ‘100%’, ‘height’: ‘100%’});

svg.attr(‘preserveAspectRatio’, ‘xMidYMid meet’);

}

});

on the other hand faces a bit more resistance. Myriad traders now see only a 49.9% chance of SOL reaching its previous peak of $295.11 by this year’s end.

With the token currently trading at

, it would need a 34% rally. This seems unlikely given its ETF uncertainty and slower adoption rate. Just two weeks ago, the market was far more optimistic at 67%, but clearly, the sentiments have shifted.

EXPLORE: Next 1000X Crypto – Here’s 10+ Crypto Tokens That Can Hit 1000x This Year

What Do The Charts Reveal?

ETH’s technical setup is showing signs of strong bullish momentum. Its 50-day exponential moving average (EMA) is trading above its 200-day EMA, signalling a strong uptrend.

The short-term trendline, however, shows a slight downward slope, hinting at a possible consolidation or a minor pullback.

(Source: TradingView)

If momentum holds, ETH could reach its ATH by December. If not, a correction towards $3,000 is possible.

SOL’s price shows signs of steady buying, but it hasn’t locked into a string trend yet. The current RSI at 53 signals that buyers are somewhat active, though not as aggressive as ETH.

Right now, SOL is trading above its 50-day and 200-day EMAs, with possibilities of more upside.

(Source: TradingView)

The big unknown factor is its ETF approval. Several issuers believe SOL ETF could be greenlit as early as next week, which might give its price a major boost.

Suffice to say, ETH has an easier path to an ATH. It only needs a 13.8% price jump compared to Solana’s 34%. If current momentum holds, ETH could hit its peak within weeks.

Solana, on the other hand, is a wild card. Its price action has been subdued, but could break if an ETF gets a green light.

EXPLORE: 20+ Next Crypto to Explode in 2025

Key Takeaways

- Solana offers faster unstaking, allowing users to return investor funds more quickly

- In early September, over 860,000 ETH were waiting to be staked, the highest in over a year

- ETH has a better chance at reaching ATH faster than SOL, although news of a SOL ETF could trigger a price surge

The post Is Solana Is Destined To Beat Ethereum? Can Staking ETFs Trigger SOL ATH Before ETH? appeared first on 99Bitcoins.